Stephen Norman, the 63-year-old car industry veteran who took charge of Vauxhall in January, is convinced that the “major highlight” of his 43-year career lies ahead.

The task that will bring the glory to Norman and his team is the rapid restoration of Vauxhall to sales success and sustainable profitability, a project that a long line of decent managers, working under Vauxhall’s previous owner, General Motors, have already proved is no pushover.

However, having spent the first few months of his tenure devising a simple but ground-shaking five-point strategy for a Vauxhall turnaround – which I am in the company’s Luton HQ to hear about – and having had his plan rubber-stamped by the big PSA bosses with a speed GM could never have managed, Norman counts his chances of success as very good. Not that odds matter “because I don’t intend to fail”.

Such bullish declarations are unheard of for recent Vauxhall bosses, weighed down by their predecessors’ lack of success, and beholden to a controlling German management itself controlled from a US ivory tower.

They have been either competent place-holders or haven’t lasted. Vauxhall has plodded on as an ‘always-there’ kind of company, selling cars with a slightly lower brand image than they deserved to a gently declining band of usual suspects.

But decision-making is different now. Norman has a lot of authority because the UK boss’s job has been redefined. But in any case, under Carlos Tavares (with whom Norman has worked for more than a decade) and German-based Opel boss Michael Lohscheller, decisions are “extremely simple and extremely rapid”.

Sporty Vauxhall GT X concept hints at firm’s design future

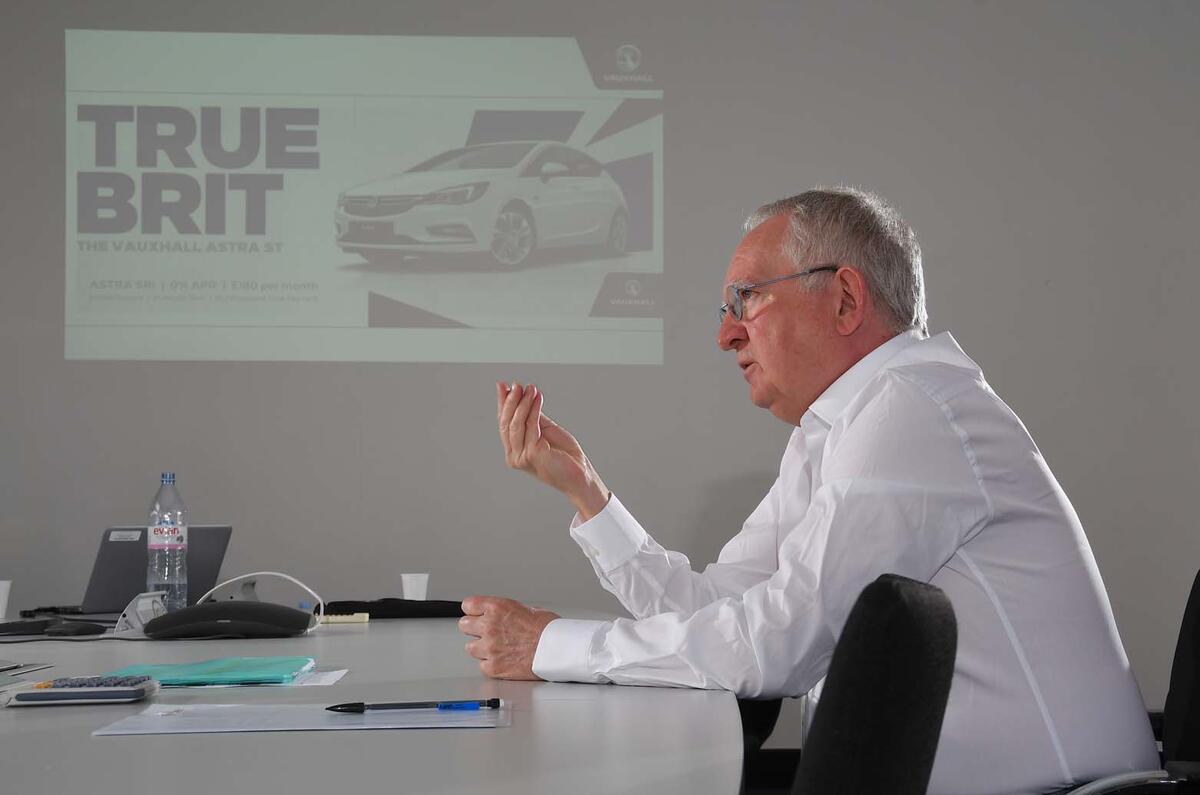

Norman readily acknowledges Vauxhall’s time in the slow lane. He’s nothing if not a realist. But when we move to a boardroom near his office – one wall covered by the simple, graphic ‘True Brit’ Vauxhall Astra ad appearing on hoardings all over the country – he begins with a short UK car market history lesson to demonstrate that Vauxhall is a far better company than many think. “I really take umbrage when people say Vauxhall is a disaster area,” he says. “It can do better, for sure, but it’s not so different now from what it always was.”

Norman produces charts to demonstrate that whereas Vauxhall (current UK market share 7.6%) was doing around 9% in the post-BL days of the early 1980s, Ford has dropped from 30% to not much more than a third of that today. Vauxhall did jump to 16% for a few years when the market suddenly saw the Cavalier as a far better bet than the Ford Sierra but, broadly speaking, Vauxhall’s fortunes have been “less irregular” than almost anyone. Premium manufacturers (whose volume has expanded from 2% to 20% in the period) are the real winners.

Join the debate

Add your comment

Car Review 2019 full video in hd 1080p 720p 3gp mp3 mp4

nice post here https://mshd24.com/search/car-review-2019

awesome

<p><a href="https://mshd24.com/search/car-review-2019"><img alt="nice" src="href=https://img.youtube.com/vi/kQYBP6WlGcU/hqdefault.jpg" style="width: 480px; height: 360px;" />Car Review 2019 full video in hd 1080p 720p 3gp mp3 mp4</a> 2019 Honda CR-V Hybrid Review – Five Things You Need To Know | What Car? by What Car?</p><p><a href="https://mshd24.com/">click now for new car review video</a></p>

I'll Have A Pint of What He's Drinking

A great future for Vauxhall really?, Vauxhall will continue as it has over the past forty years being Opel's with a griffin badge instead of the lighting flash worn by the German parent but using PSA platforms and running gear. Since the last Victor/VX and Viva/Magnum rolled down the line in the seventies the only product badged as a Vauxhall that's not been an are the Monaro(Holden) Monterrey (Mitsubishi), Sintra (GM US) VX220(Lotus) and the VXR8 (Holden again) Now the first vehicle with a Griffon on the front is the Vauxhall Combo which looks awfully like a Berlingo/Rifter with a Vauxhall badge on,not exactly an encouraging sign is it? As there aren't that many Vauxhall sales in Europe compared to Europe and with the departure of the UK from the UK ,I wouldn't be surprised at all if PSA treat this "Great British Brand" like they did with Talbot that didn't last too long did it?

ianp55 wrote:

You have managed to display huge ignorance in just a few words. What brand/model of vehicle did you spend your hard earned on, given those foolhardy words?.