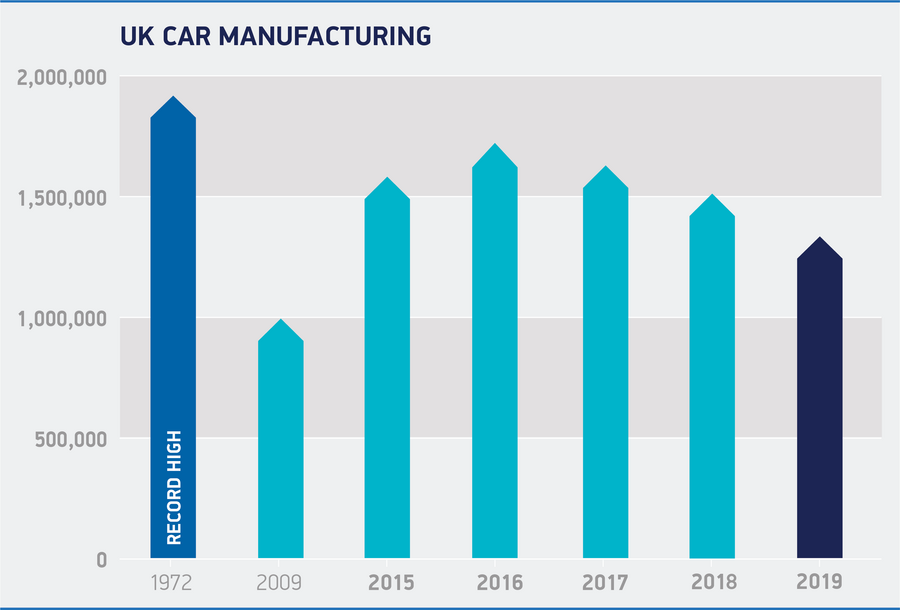

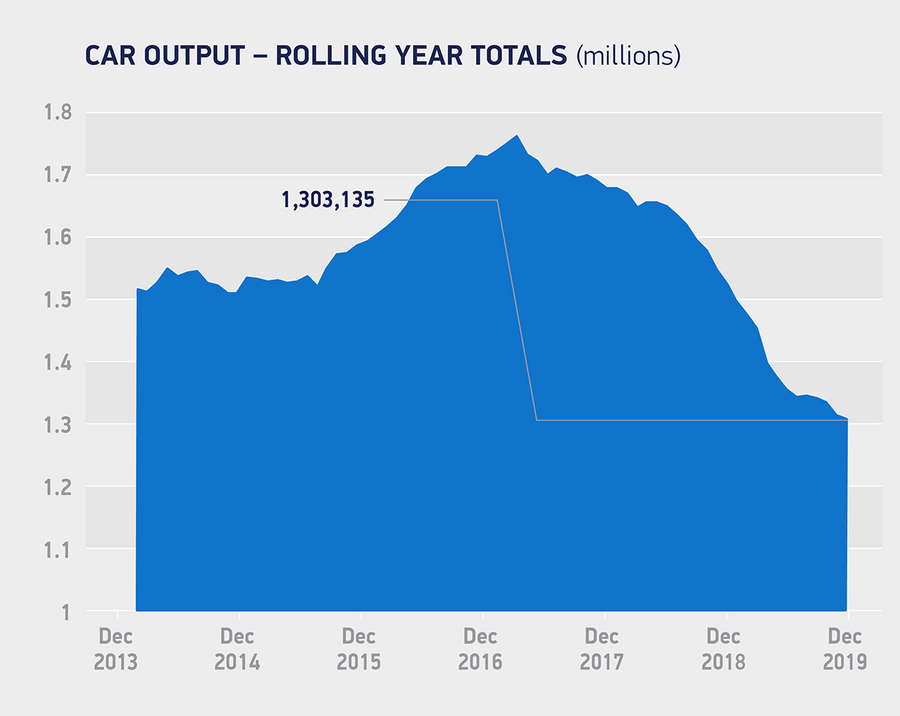

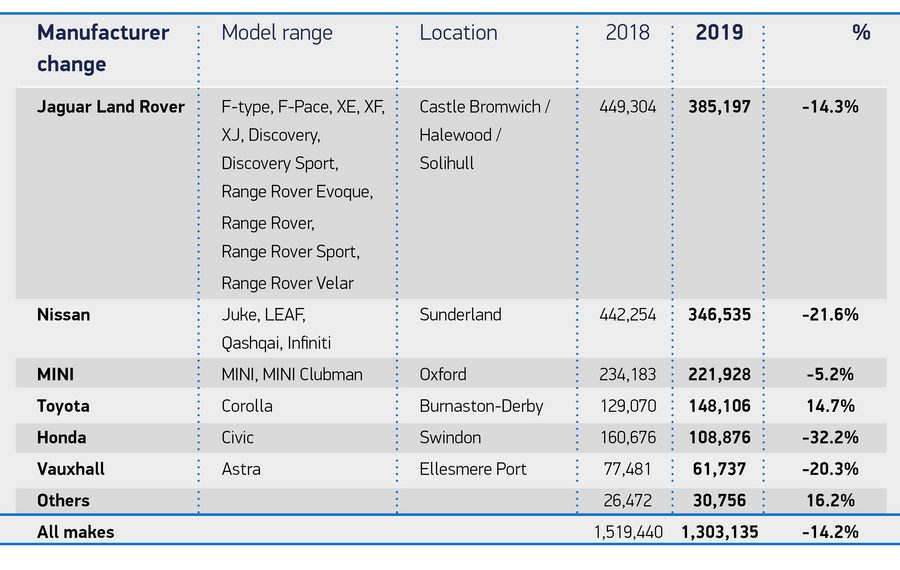

Car production in the UK dropped for the third straight year in 2019 to fall to the lowest output since 2010, according to newly released figures from the Society of Motor Manufacturers and Traders (SMMT).

The 1.3 million production figure was a 14.2% drop on 2018 and more than 400,000 units down on the highest figure in modern times of 1.72m units in 2016.

SMMT boss Mike Hawes said the latest fall was down to weakened business and consumer confidence in the UK, the continued drop in demand for diesel models (of which the UK is a large producer) across Europe and a drop in demand in key export markets, including China, Japan and the US.

Now that the prospect of remaining within a customs union with the EU has been removed, Hawes has also called on the Government to ensure a free trade agreement with the European Union that includes tariff-free and quota-free trade between the UK and EU for the automotive industry in a trading deal that the Government has said it will negotiate before the UK/EU’s post-Brexit transition deal on current terms expires at the end of 2020.

That’s significant, because, 81% of all cars built in the UK last year were exported - with the EU taking almost 55% of that figure at 576,000 units.

Hawes said there is a desire from automotive industries on both sides of the Channel to strike such a deal, given that the UK imported more than 1.6m vehicles from the EU in 2019 – some seven out of 10 of all cars sold here. “We are still very dependent on the EU for exports and imports,” he said.

Striking such a deal will not only preserve that trade, believes Hawes, but also free up an expected bottleneck of decisions from car manufacturers to invest in UK production sites due to uncertainty around the UK/EU future trading deal, most notably with the PSA Group’s delayed decision on whether Vauxhall’s Ellesmere Port factory will build the next-generation Astra. Hawes believes delays on decisions like this show that the UK car industry is not in cyclical decline, with car makers believing they can grow businesses here with the right conditions.

Hawes has made clear to the Government, including business secretary Andrea Leadsom, the SMMT’s position on what a future trade deal should look like, and while he doesn’t know whether the Government would extend the current transition phase beyond the current 31 December deadline, he does expect the UK’s position on what that trade deal should look like to become clear in the space of a few months to allow the delayed investment decisions to be made.

Join the debate

Add your comment

No doubt Speth will head back

No doubt Speth will head back to India(TataSons)and arrange to close more of JLR in the U.K.

Not to worry though because BoJo is on the case and he can say yes to HS2 and soak up some of the West Midlands unemployed.

Perhap the remainers like

Broken record

Maybe if the EU hadn't paid JLR and Ford to build factories elsewhere in Europe, car production wouldn't be at these levels in this country.