The automotive industry is emerging from the pandemic reshaped by the events of the past year. Will things slowly return to normal or – like the switch to electric – is the rate of change only going to accelerate? We’ve asked key industry figures how current trends are informing the direction of travel.

Online sales

It’s no surprise that new companies such as Cazoo and Cinch have appeared and announced that online sales are booming and are here to stay.

One firm that launched during the height of the pandemic is Carzam. Its CEO, Kirk O’Callaghan, believes the future of online car buying looks strong, with sales having increased even after showrooms reopened on 12 April.

“The pandemic has accelerated a change in customer behaviour,” he said. “When customers understand the benefits of buying a car online and how they can purchase with safety and confidence, they do so.”

For car manufacturers and consumers alike, it’s fortunate timing that the technology was on hand to allow car buying to continue during the lockdown.

“More than a year into the pandemic, we’ve seen some major trends gather pace in the new car market, most obviously in the enforced reliance on online sales,” said Mike Hawes, the CEO of the Society of Motor Manufacturers and Traders. “The success of click-and-collect services has provided a lifeline for the sector by sustaining sales through much of the outbreak.”

As ever, it isn’t a case of one or the other: customers are using hybrid methods to shop for their next car. For many, then, at least part of the buying experience will continue to be at a physical dealership. Hawes said: “The recent reopening of showrooms could not come soon enough, and as much as digital car buying has been proven to work, it can’t replace the excitement of choosing and test driving a new car in person.”

Some operations are even investing in new facilities. Porsche GB told Autocar that investment by its retail partners in Porsche Centre development will continue in 2021 and 2022. It said this underlines its commitment to physical retail showrooms and follows three new Porsche Centres opening in 2020.

The same is true of large dealer groups, with Vertu Motors CEO Robert Forrester finding the use of e-commerce to be very low. According to Forrester, people are going online for initial viewing and video chats, but most are then visiting the physical dealership to see the actual car and complete the deal.

That’s reflected in the figures: Vertu sold 130,000 cars through its dealerships in 2020, but just 428 of them in purely online transactions.

As a further indicator of where Vertu sees the market heading, the firm is investing in new showrooms. “The death of the dealership is an easy story to write, but I’m not sure it’s true,” said Forrester.

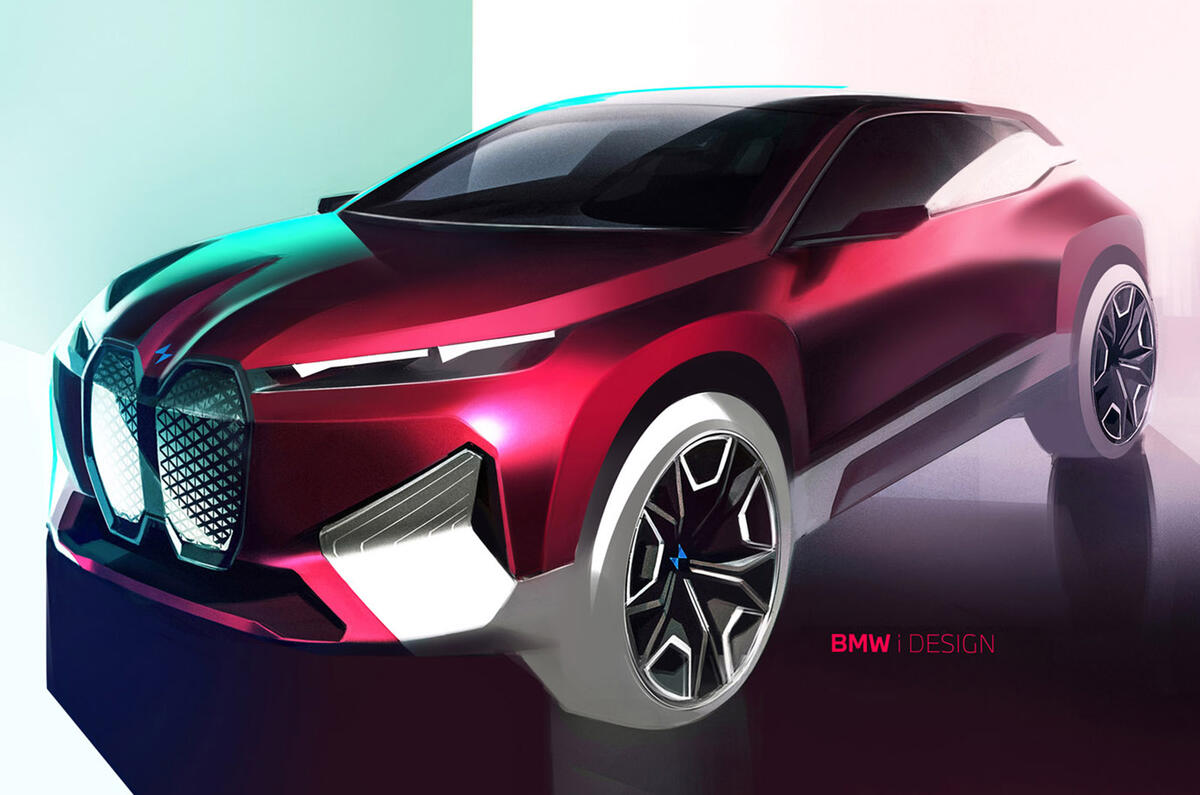

The direction of design

Design is likely to become increasingly important for car makers. In a world where EVs will deliver similar powertrain characteristics, brands will need to distinguish themselves from others by creating cars that look different. It’s no coincidence that as Jaguar Land Rover embarks on its Reimagine strategy, Gerry McGovern (now chief creative officer) is front and centre of where the firm sees itself.

Join the debate

Add your comment

More tech = less reliability and less repairability. Ceiling fan with a little on/off chain runs for ever, one with a remote craps out after a year. Washing machine with rotary controls runs forever, one with microchips craps out after a year. Light bulb operated off a wall switch lasts forever, one that comes on when you tell Alexa to turn it on craps out after 3 months. I'm not a luddite, I try to adopt new tech, but it continues to disappoint in so many ways. I am really starting to dislike cars that are always bleeping at me, grabbing the steering wheel, making me signal to change lanes when there's no one around etc. Car interiors are just becoming annoying, fussy, stressful places. Do I set my BMW's electric windows to comfort, sport or track? Etc. Etc. Only Rolls Royce seems to have the right idea. Good service is discreet, not in your face. Pour me another one, love.