The values of some used diesel cars are actually increasing despite the fading appeal of the powertrain in the new car market, say leading vehicle valuation experts.

In the first half of 2025, just 58,722 new diesels were registered, down 11.3% on 2024. This continues a decline that can be traced to 2017, amid the fallout from the Dieselgate scandal and concerns about future vehicle taxation and emissions penalties.

Diesel’s days appear numbered. Only a few car makers still produce diesel models – among them Audi, BMW and JLR (especially with the Defender) – and other types, such as petrol, hybrid and battery-electric vehicles, are experiencing rising demand.

For most diesel models, this is reflected in increased rates of depreciation, but, bucking this trend, some have actually increased in value over what they were worth a year ago.

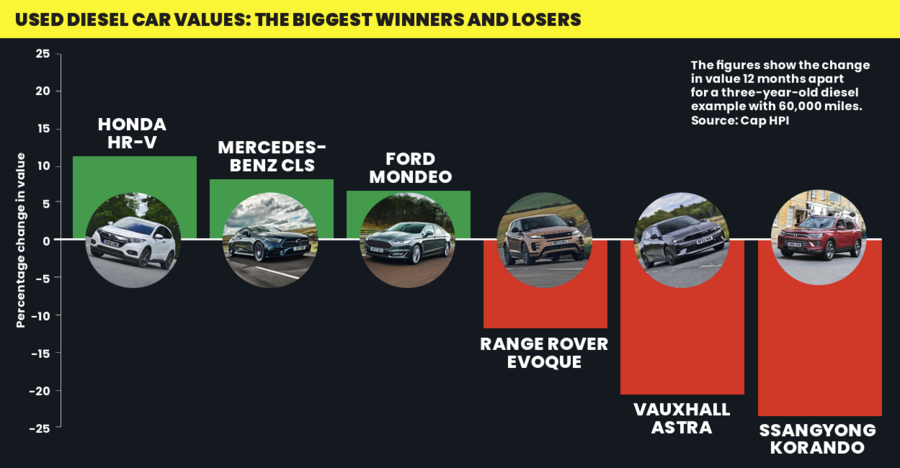

For example, according to Cap HPI, a three-year-old diesel Honda HR-V with 60,000 miles is worth 11.3% more today than the same model was at the same point last year. In addition, the value of an equivalent Mercedes CLS has risen 8% and a Ford Mondeo 6.5%.

Explaining the figures, Dylan Setterfield, head of forecast strategy at Cap HPI, said: “There is still demand for diesel in the used market from both consumers and dealers, with fuel economy continuing to be a significant factor for high-mileage drivers.

“New [diesel] car volumes have been decreasing for some time, and this is translating into reduced used car volumes. We expect these reductions to be partially offset by the ongoing reduction in consumer demand and that prices will behave similarly to petrol [car prices] in the next few years.”

However, the market is experiencing wild valuation extremes and some models are instead depreciating at higher than expected rates compared with what they were worth last year.

Those suffering the biggest falls in value include the Ssangyong Korando 2.2D, with a three-year-old example with 60,000 miles worth 24.5% less. An equivalent Vauxhall Astra is down 20.2% in value and a Range Rover Evoque down 12.7%.

These losses are atop the models’ regular year-on-year depreciation. Setterfield said: “The Korando’s falls seem to have been caused by uncertainty and confusion in the marketplace as the brand transitioned from Ssangyong to KGM. Astra diesels with above-average mileage are now suffering increased penalties, while the Evoque’s figure can be explained by an increase in used volumes following a shortage of supply.”

Join the debate

Add your comment

IMHO HVO diesel in a Euro 6 vehicle is remarkably clean, green, efficient and pretty carbon neutral (especially compared to EV's using electricity generated by fossil fuels) , but politicians will never backpedal far enough to agree.

Never heard the burning diesel being described as Green and Clean before, if you sat in garage with the engine running you'd soon find out it wasn't Clean.

As to ...compared to an EV running on fosil fuels, well over 50% of electricity created last year came from renewables. For cars plugged in overnight using the cheap rate the percentage is even higher.

I'm sure you'll agree.

what about the little child slaves in Africa and the environmental damage caused by mining all the lithium and other precious metals that go in EV's, all so that we can virtue signal!

recent research by the University of Southampton showed that tyre pollution from large heavy EV's actually EXCEED that of diesel cars in many cases!

Modern diesels are no good by the second or third owner. Too complex, too troublesome and too expensive to repair.

In our haste to be green we have made modern cars throwaway disposables.

Not exactly a green policy. Governments to blame, not the manufacturers.

Cars should be run for 20 years but few will even make it to ten years old before they are too expensive to repair.

Add in other useless modern tech like wet belts, plastic water pumps, dry clutch automatics etc and no sane person will buy a ten year old 2025 car.

Rubbish.... "few will even make it to ten years" modern, well equipment, efficent cars, especially petrol, on the main last 20 years (rust free). Compare a Mk2 Escort to Mk4 Focus.

Keep to the maintenence schedule and the Focus, like pretty much all cars, will make it past your ludicrous 'few will even make it to 10 years' comment.

Not to mention the high cost of belt changes.

There is a reason lots of cheap MK 4 Focuses are cluttering used car lots.

PSA too. Will still last longer your 'few cars will reach 10 years old' rubbish statement.