Ford has warned that a £760 million decline in European revenues last year, much of it attributed to the weaker pound pushing down the value of earnings in the UK, could lead the company to take “whatever action is needed” to remain profitable.

The Independent reports that Ford warned of the potentially drastic action amid rising fears of a no-deal Brexit, with ever more UK-based car makers fearing for their businesses with the threat of increased costs.

Other manufacturers that have issued similar warnings include Jaguar Land Rover, parts supplier Unipart and BMW, which have all suggested that a no-deal Brexit could have severe consequences on their UK operations.

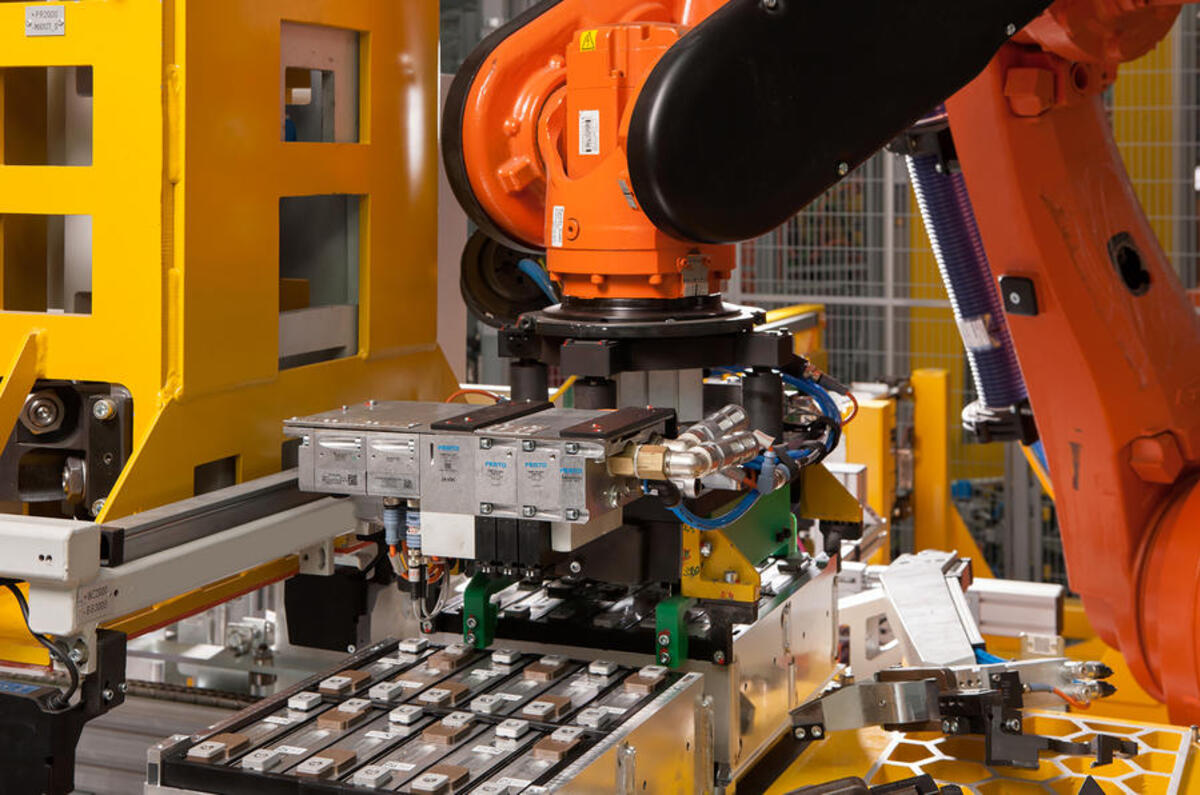

In 2017, Ford’s earnings dropped by £760m in Europe, and the brand said £460 million of this was down to the falling value of the pound since the UK’s vote to leave the European Union. Ford has three facilities in the UK; transmissions are made in Halewood, Merseyside petrol engines are put together in Bridgend, Wales, and diesel engines are constructed in Dagenham, Essex.

“If I’m forced to go out because we don’t have the right deal, then we have to close plants here in the UK and it will be very, very sad. This is hypothetical, and I hope it’s an option we never have to go for,” said JLR boss Ralf Speth earlier this year.

Speaking to the Mail on Sunday, McLaren boss and former Ford manufacturing vice-president Mike Flewitt also expressed concerns about post-Brexit automotive logistics, saying: “How will we be able to import components? Export cars? Well, we don’t actually know how to trade with each other under those terms.

“These are genuine fears. The people I feel most sorry for are some of the car companies that came and invested in the UK through the 1980s and 1990s to make Britain their base for trading in Europe.

“If all of a sudden their trading terms change, that whole investment is almost called into question.”

Read more:

Jaguar Land Rover boss issues fresh hard Brexit warning

Brexit: EU single market is ‘critical’ to UK automotive sector

Join the debate

Add your comment

Brexit my arse!!!

Come March 2019 the EU will suddenly and steadfastly refuse to export to the UK... bollocks

Would be quite interesting to see what would be the outcome of "no deal"...

At worst it would be a "tit for tat" scenario, the UK manufacturing industry is deeply entwined with its EU counterparts, in a "no deal" environment I forsee some "backdoor" deals emerging whereby UK exporters ship via CKD sites with an EU trade deal. Job done as they say...

kboothby wrote:

Given that May is utterly spineless as a leader, and that those Conservatives who are pro-Brexit, such as Gove and Mogg, are apparently unwilling to mount a leadership challenge because a majority in the party won't vote for a pro-Brexit candidate, a failure for the two sides to agree a deal is the best for which we can hope at this stage. It was a castrophically short-sighted decision to elect another pro-EU party leader after Cameron's resignation, and still, it would appear, most of the Conservative party has failed to recognize their error.

May is so weak, the way her mouth wobbles every time she is asked a tricky question is pathetic, she couldn't lead a dog to a lamppost, never mind lead a country. If they come to their senses it isn't too late to start again, lay down exactly what we require from a deal, and inform the EU they can take it or leave it, as we'd be happy to go for a no-deal departure. The EU would be likely to take it, as no deal represents a greater problem for them than it does for us. Sadly, it currently seems that spineless May lacks the conviction to go with her words and will accept a not-really-leaving package rather than tough out the negotiations. Eventually she will find that betraying us will cost her more pain than acquiescing to the EU will save her.

Ford's self-inflicted woes

Ford have got themselves into serious financial trouble in Europe by investing hugely in new Fiesta and new Focus instead of new SUVs - which they know full well (together with light/medium commercial vehicles) are massively profitable. Very undiplomatic and bad PR by Ford to blame their traditional "cash cow" UK market for their woes - it's the massive risk Ford took and has backfired when they specifically, deliberately and pre-meditatedly decided to move to Germany, and import everything (including new generation petrol engines) into the UK. Ceasing production of all MPVs and Mondeo illustrates what a calamitous situation Ford has got itself into in Europe. Even when electric vehicles finally appear, it may just be a plant in Germany or Spain which will be tagged for closure - which is what happens when you buy and invest in an old Daewoo / Chevrolet plant in Romania.

Ford in a tight corner!

Should a bad Brexit scenario develop, it will be a simple matter for Ford to transplant the equipment neede to make engines and transmissions to other plants in the EU or other trading countries (Turkey?)

Even if some 'assets-stripping' regulation was invoked, the bean-counters would soon find ways of by-passing the problem: selling off the plant cheaply in the UK is one solution; the buyer may then choose an 'export' customer'? Keeping so much equipment idle makes no sense, does it?

One thing is for certain: the future of so many family guys is at stake here; let common sense prevail for once?

I work for ford at Bridgend.

I work for ford at Bridgend. They were pulling out anyway, Brexit has come along at just the right time for them to use as an excuse.

When they purchased the old Daewoo plant in Romania back in 2008 the writing was on the wall. That's ten years to build up a workforce to be able to assemble engines/cars to a quality that we have here. JLR contract is ending Sept 2020 or earlier.

There is a new line gone in for a 3 cyl engine but the volume is very low compared to what we make now. How long that lasts is anyone's guess but it certainly can't sustain a plant of this size.

aphill24 wrote:

I had suspected as much. Didn't seem like there was much reason to stay beyond JLR.

No doubt their real concern is selling cars into the UK market. Losing tariff free access would be bad news for plants in Germany and Portugal producing the Focus and Fiesta.

Nuff said

We live in a Global Economy where corporations have a bigger GDP than many countries, Brexit is a smokescreen employed to frighten the populace, to satisfy certain politicians and their Federal State of Europe dreams. Business will migrate to where it suits them best, witness Google, Amazon et al who have no manufacturing per se but sell a "service", they will choose a domicile that suits their position in the market, Manufacturers with a "tangible" asset to sell will weigh up the pros and cons of labour cost, tariffs, transportation and taxes to establish the best location to produce their goods and maximise shareholder return....