Aston Martin faces the ‘semi-catastrophic’ prospect of having to temporarily halt production if the UK government fails to secure a Brexit agreement with the European Union, the firm’s financial boss has told parliament.

Giving evidence to the Business Select Committee, chief financial officer Mark Wilson said potential problems with vehicle certification could significantly affect the company.

Currently, all new cars in the UK must secure Vehicle Certification Agency (VCA) approval, which is valid in the EU. But, if a Brexit deal is not reached, VCA validity for new models in Europe could cease in March 2019. Companies are not allowed to hold simultaneous type approval from two authorities, therefore if UK firms were forced to apply for new vehicle certification that would be valid in Europe, they would have to stop production while doing so.

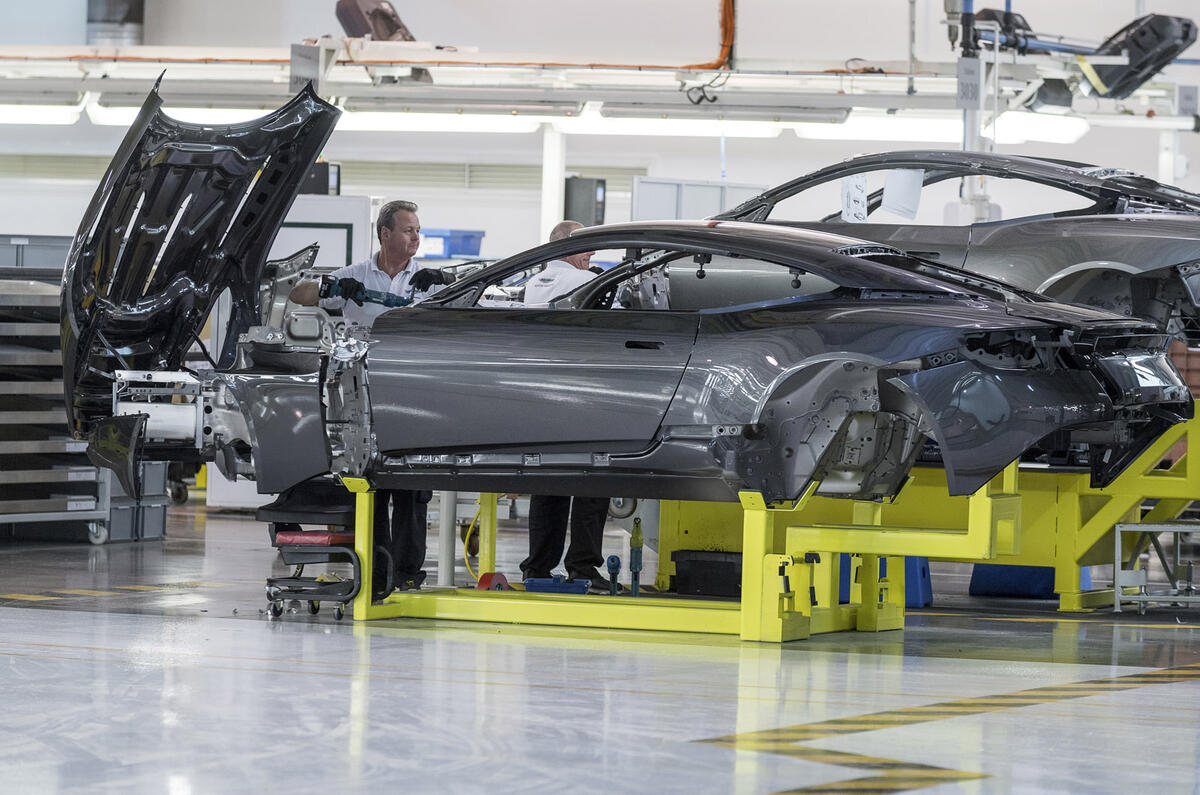

“For Aston Martin, it’s simpler than for larger international players,” Wilson told the committee. “We’re a British company, we produce our cars exclusively in Britain and will continue to do so. Without VCA type approval, it really is a stark picture for us. We need to make sure that type approval carries over, has validity and recognition, and has the equivalence it has today.

“Otherwise, there are significant costs involved in gaining another type approval, but also the semi-catastrophic effect of having to stop production, because we only produce cars in the UK.”

Wilson added he was “encouraged” that a transitional agreement would be reached that would allow production to continue, but added: “During that transition, we would have to look at how Aston Martins were recertified under a non-VCA structure.”

Car industry in further clarity calls

Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders, and Patrick Keating, Honda Motor Europe’s government affairs manager, also gave evidence to the committee. Both joined Wilson in calling for clarity over a Brexit transition deal.

Asked whether a lack of clarity over Brexit could impact investment in the motor industry, Hawes said: “Companies don’t just make an investment at one particular point, there’s constant investment. Some investments are overdue, and some are waiting as long as possible for clarity.

“Looking at the timetable for leaving the EU, the general view is that companies need more certainty by the turn of the year, because contingency arrangements will have to be put in place to give you a good 12 months before you start.”

Join the debate

Add your comment

Brexit ate my homework

I'm glad that brexiteers and remainers both have perfect 20:20 vision for the future. I believe in all of you, and you are apparently all right. So I will follow both.

Truth or lies?

That's really the bottom of your post. Who was telling the truth or lies?

Farage on the morning after the referendum openly stated it was all lies from the Leave campaign. So that answers half the question.

Currency has dropped, there's jobs being lost to Europe, and trade barriers will go up, even just small ones which will affect SMEs the most in the UK. Cost of living is already up but wages haven't followed. This was predicted by the Remain campaign.

On balance, the truth is firmly with the Remain campaign.

It's difficult to predict the future, but what we've seen already is the worst off in society are getting even less out of Brexit than they had before. Big Leave supporters like JCB and Dyson aren't going have their standard of living severely affected by Brexit, but the ordinary person already has.

Brexiteers always try trotting out the same flawed arguments

Brexiteers always try trotting out the same flawed arguments about the EU27 conceding just because of BMW/Audi/Mercedes/VW UK sales figures.

Brexit will be curtains for volume UK car manufacturing in the long term, with models transfering production elsewhere. And that means the UK auto supply base will also be wiped out.

It's time for any doubtful or wavering Leave voters to let their MP know that they now question the logic of leaving the EU.

@Ski Kid

Instead of saying "Probably" try googling the stats. After 5 seconds you'll realise that it's not 50% of the german output, but 14%. Their largest export customer yes, but they're hardly going to worry about that in comparison to the other 86% which they'll prioritise.

Phil R wrote:

Exactly - roughly one in seven cars built in Germany head to Britain.