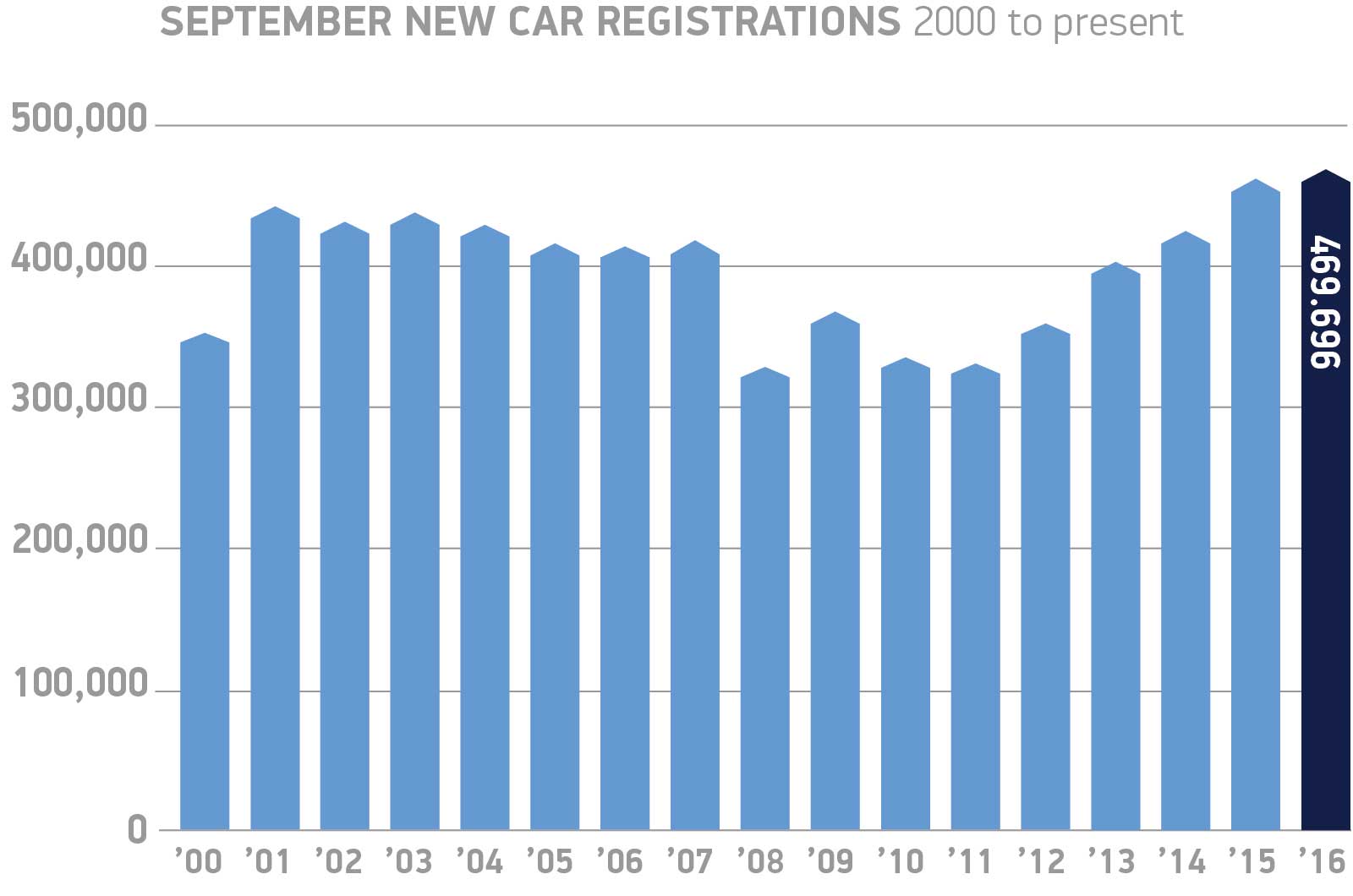

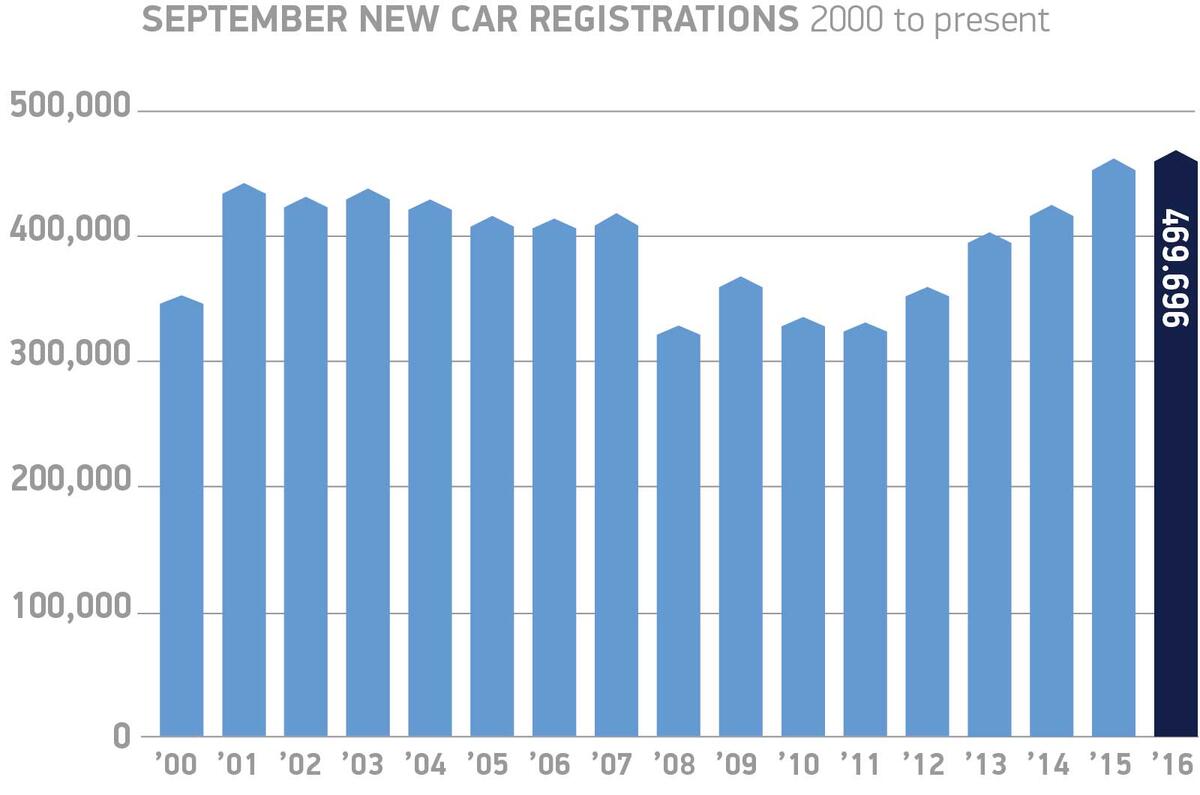

The UK car market has remained strong despite concerns Brexit could cause a downturn, recording the best September on record last month.

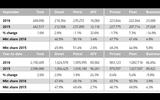

SMMT (Society of Motor Manufacturers and Traders) figures show that September contributed 469,696 cars bringing the year to date total up to 2,150,495 and representing a 1.6% increase on the month before.

Diesel models saw an increase in demand and beat September 2015’s sales by 2.8% with 218,364 units, while alternatively fuelled vehicles continued with strong growth to beat last year’s September demand by 32.6% after 16,060 cars were sold.

Conversely, petrol car sales were down 1.1% on September 2015, but still accounted for the majority of overall sales, with 235,272 units sold.

The Ford Fiesta continues to be Britain’s favourite model, selling in 19,769 units compared to 14,570 for the second placed Vauxhall Corsa. The Volkswagen Golf sold in 11,003 units last month ranking it third, beating the Ford Focus by a slim 11 cars.

The top 10 best-selling cars in the UK over 2016 so far are as follows:

Ford Fiesta 96,139

Vauxhall Corsa 64,925

Ford Focus 57,137

Volkswagen Golf 54,934

Nissan Qashqai 50,923

Vauxhall Astra 44,771

Volkswagen Polo 43,642

Mini 36,738

Mercedes-Benz C-Class 34,994

Audi A3 33,240

The SMMT’s chief executive Mike Hawes cites the new 66-registration plate as a key reason for September’s strong sales.

“The new plate, combined with a diverse range of exciting new models featuring the latest technology, has certainly helped draw buyers into showrooms and many are taking full advantage of the attractive deals and low interest financing options on offer,” he said.

“Business and consumers place September orders many months in advance, so the ability of the market to maintain this record level of demand will depend on the ability of government to overcome political uncertainty and safeguard the conditions that underpin consumer appetite.”

Join the debate

Add your comment

UK's Favour 2

European made cars will not only be 10% more expensive because of the exchange rate but will also have another 10% tariff slapped on them.

Whereas UK manufactured vehicles with a 10% import tariff will be eliminated by the fall of the value of the Pound.

UK's favour

Good news for UK