Earlier this week, Volkswagen denied a story that it was running into financial problems, caused mostly, it was claimed, by the massive investment involved in rolling out its huge range of models based on the new MQB platform.

According to analysts at Morgan Stanley, the bill for the whole MQB adventure – which includes the cost of converting over 20 factories to build the new architecture – could come to as much as £70 billion. Usually, that sort of industrial investment is in the realm of military engineering projects, such as the Lockheed Martin F22 stealth fighter.

The MQB will eventually underpin around 40 different models across various VW Group brands, and the economies of scale when you are buying, say, millions of identical seat frames every year, are potentially massive.

But Germany’s Manager Magazin claimed earlier this week that VW was going to miss its planned profit margins as the company saw sales dipping in Europe and the costs of rolling out the MQB proving to be higher than expected. The magazine’s assertion was strongly challenged by VW, which said that the suggestion it would not meet its targets ‘was wrong.’ Arguably a classic non-denial denial, which could mean VW will indeed meet its profit target, but will also have to get stuck into some serious cost-cutting.

There have also been hints that Audi is a similar position as it invests heavily in MLB-evo. This new architecture is thought to be a mix of steel, aluminium and even carbonfibre that uses riveting and bonding in its construction. It will be used for the new Audi A4 and the models above it.

With new production lines and a whole line of new components, it’s another monumental expense for the VW Group. The suggestion that Audi, without cost cutting, might also miss its profit margin targets – as the costs climb with the roll-out of its MLB-based cars – does not seem far fetched to me.

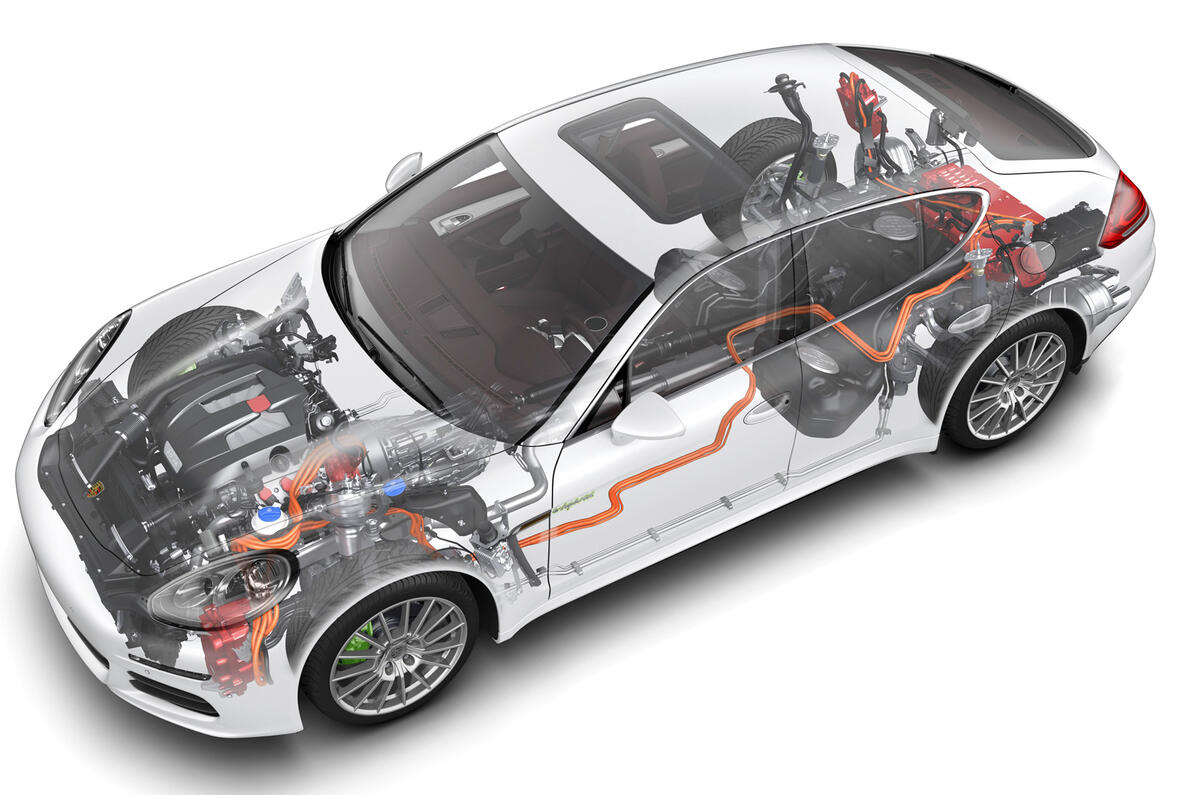

Oh, and there’s the new MSB architecture. A development of the current Porsche Porsche Panamera platform; MSB is also thought to be another mixed-materials platform and will be used by Bentley and Porsche and could also underpin the new VW Phaeton.

Join the debate

Add your comment

Airbags, ABS

Reply to JacobE: ABS and airbags

1 hour 16 min ago

The Mark III Granada was the first European volume production model to have anti-lock brakes fitted as standard across the range. Oldsmobile Toronado offered driver's and front seat passenger's airbag in 1973, 16 years before driver's only was offered as a standard fitment on S-Class. Beware of Germans re-writing history.

Pauld101, I think you are confusing Passive Airbags with Supplementary Restraint System airbags (the modern type that are fitted to cars now).These were available on the S Class from 1980, with electronic distribution ABS a good 5 years earlier. Whilst it was good the Granada had ABS it could be argued its poor dynamics were one of the reasons to include it.

Back to the point, VW do look to have spread themselves too thin, with even its own models competing against each other. The huge costs of developing their new platforms probably will be offset by lower construction costs, but you have to think, with such an investment, they need to shift a heck of a lot of cars in 10 years (presuming this platform lasts that long) to recoup their costs. Compare the investment vs depth of engineering between VAG and MB for example, it seems MB are a much more focussed company.

£70bn?!

Admittedly it's an upper-end figure from the looks of things, but that sounds like a slightly questionable estimate for the introduction of one platform. I can't see how it would cost circa £3.5bn to retool each factory, unless they are literally having to demolish the old buildings and start again from scratch. Sounds like someone at Morgan Stanley wanted to get them back in the headlines...

What about a back-lash

What would be the effect of a back-lash from the ordinary buyer when they find that their premium model either costs a fortune to repair when it goes wrong or simplyfails the ever more stringent MOT tests after it is two or three years old and then cannot be be brought up to standar. Not everyone can afford a new car every three or four years. The recent changes to the MOT test in the UK will, I've been told by a test station manager, take many perfectly serviceable cars off the road for relatively minor "failures" that don't affect safety in general. Manufacturers seem to have been colluding with regulators to make cars more and more complicated and technology heavy to effectively shorten their life and boost sales of new cars. I for one would think very carefully about buying a new car with lots of gadgets.

ordinary bloke wrote:Not

spot on. A traction control light illuminated on the dashboard is an immediate MoT failure. Like discovering the chassis has rotted away, a simple glitch in the car's brain with a light to show it's happened might well write the car off.

The old model Citroen C5 was a demon for such problems. The stability control warning would come on seemingly without provocation, deactivating the ABS in the process, and it's an incredibly hard problem to diagnose. There are two or three things that might cause the light to show, and I've known of cars where the owner had no choice but to swap out the ECU for a new or exchange unit - which of course may or may not exhibit the same factory flaw. The cost of this plus labour is typically more than the value of the car.

Answer: throw car away. I mean, good grief.

I posted something similar last week, that cars are now so complicated that to repair the simplest electronic fault of a ten year old anything is no longer economically viable - and there are electronics everywhere now, particularly on the more vulgar German toys. A chap I work with had an A4 from new which after four years developed a loud and persistent CLACK noise from behind the dashboard whenever you made changes to the heating or ventilation system. This was a CLACK loud enough to make you jump. It was caused by one of the electronically actuated vents deep inside the dashboard, and having been quoted a sum in excess of £2,000 to repair it (dash out job) he palmed the car off to webuyanycar.com

Caveat emptor. Then again, many buyers of so called premium models get what they deserve.