The message was as bleak as it was clear. “If Europe is pursuing this legal target, there is no single business case for cars the size of the Volkswagen Up,” Volkswagen sales and marketing boss Jürgen Stackmann told Autocar at the recent Geneva motor show.

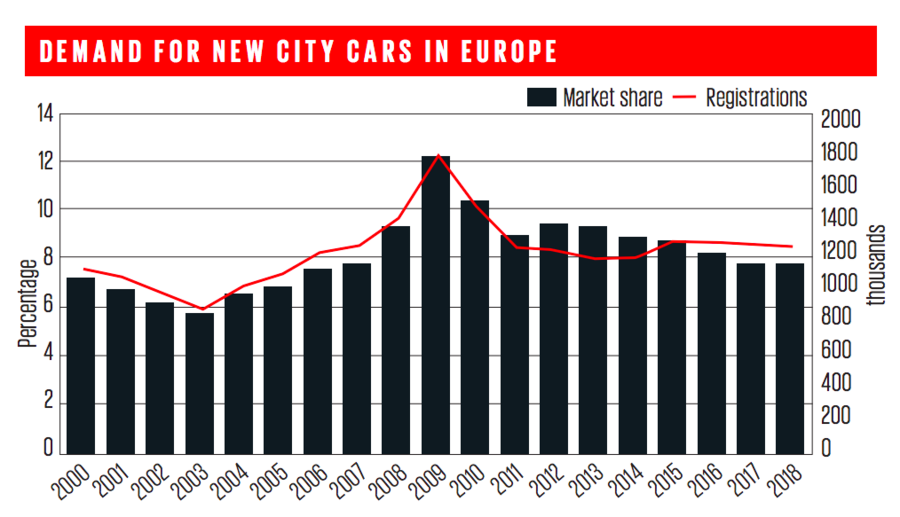

These are words being echoed around the automotive industry, triggered by incoming legislation to reduce emissions and enforce higher minimum safety standards, both of which threaten to add significant cost to cars already being sold on paper-thin profit margins. The city car is facing extinction.

One source Autocar spoke to estimated that the profit from the sale of some city cars is as little as £100 per car for the manufacturer and a further £100 for the retailer. Servicing usually nets another £100 of profit, but because the cars are relatively cheap to buy and run, few buyers use the approved franchised network beyond two years, removing further earnings potential.

So what can be done to save the city car?

Multi-brand co-operation

The VW Group has led the way in trying to achieve profit via scale, selling the almost identical Up, Seat Mii and Skoda Citigo. At their peak in 2013, they achieved a combined 202,000 annual sales in Europe.

And still, as Stackmann says, it is struggling to achieve enough sales to make manufacturing the car profitable. Fresh from Geneva, where Fiat reimagined the Panda as an electric car, Fiat Chrysler Automobiles boss Mike Manley believes necessity may be the mother of invention – and that invention may require cross-company co-operation.

Join the debate

Add your comment

"VW led the way"??? Think again: PSA & Toyota

Multi-brand co-operation

"The VW Group has led the way in trying to achieve profit via scale, selling the almost identical Up, Seat Mii and Skoda Citigo. At their peak in 2013, they achieved a combined 202,000 annual sales in Europe".

Nonsense. VW followed years AFTER the Kolin triplet 107 + C1 + Aygo. Plus, this trio scored > 260.000 units p/a.

Saving the City Car

Would prefer a new Kei Car inspired multi-tiered class of City Cars, essentially in the manner of the original Mini and pre-1998 Kei Cars or (infamy aside) even the Rover Metro/100 in terms of dimensions and weight as well as near all-round visibility. Yet featuring sub 1-litre (petrol/butanol/etc) engines with displacement ranges of around 750-1000cc and a maxium power output of around 76-100+ hp or so. Such cars should embrace minimalism aside from concessions such as air-con and possibily mandatory automatic / CVT gearboxes (with domestic Japanese Kei Cars alreadying featuring speed limiters).

The lack of such cars is pretty depressing, even todays City Cars are too large for my taste and remind me of those overregulated future cars features in Demolition Man.

kei cars!!

kei cars are awesome! but the eu has issues with them, so we aren't allowed. i don't know if the uk would or wouldn't as a stand-alone operation, so you can't take what i've just said as being some anti-eu propaganda. classic minis (newly built with bmh shells) with kei engines, how's about that? or, some motorbike incentives. watch the top gear vietnam special again, and then imagine how much traffic we wouldn't have if more people were on bikes.