Carlos Tavares - the boss of the renamed, rebranded PSA Group - didn’t hold back in his hour-long presentation about the future of the company last week.

Tavares joined PSA in 2014, when the family-controlled company was looking decidedly close to death. He had been one of Carlos Ghosn’s right-hand men at Renault when he publicly expressed enthusiasm for running a car company himself and perhaps one that wasn't Renault-Nissan.

Tavares was soon on the job market, but quickly found himself running PSA. If he wanted a challenge, PSA was about as big as it got. Tavares finally gained access to his office just a few weeks after the company was rescued by a buy-out involving the French state and Chinese car maker Dongfeng.

Each took a 14% share in the company for a cash injection of around £650m. A deal had to be made to keep PSA’s finance arm open, a factory was closed and 11,000 jobs went - an almost unthinkable move in modern France. However, with losses of £4bn in 2012 and £1.8bn in 2013, this was not as unthinkable as the whole operation grinding to a halt.

Tavares’s packed presentation last week opened up with a very punchy figure. The average PSA profit margin between 2001 and 2015 had been just 1%. It’s a remarkable admission. A 1% margin does not seem to be remotely enough to pay for the next generation of new products, so it’s hard to see how Peugeot and Citroën managed to navigate its way through the last 15 years.

True, Tavares finds himself in the remarkable position of seeing a turnaround in Peugeot’s fortunes that nobody expected. In February PSA announced that it had made profits of around £730m in 2015, compared with a £517m loss in 2014. That’s a remarkable £1.25bn turnaround in just 12 months.

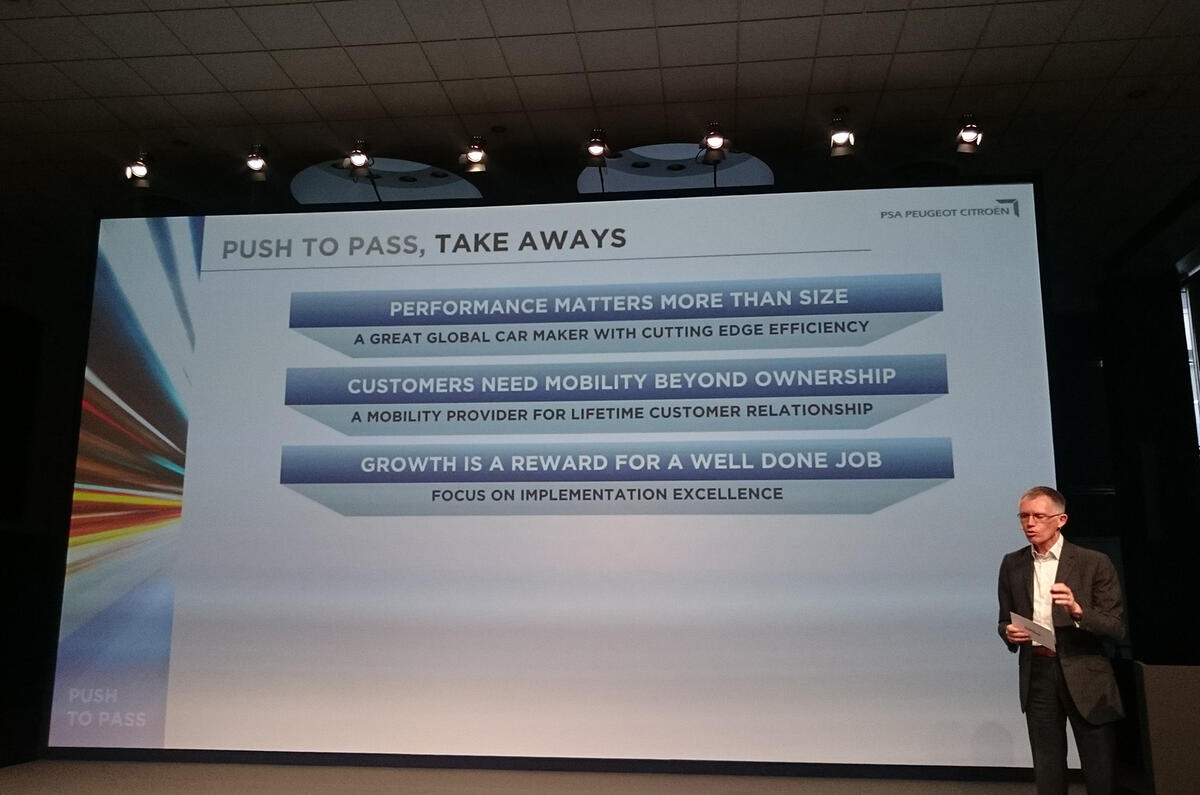

He also wants to see PSA’s newly gained 4% profit margin retained for the next three years, before pushing it up to 6%. Perhaps even more surprising, he wants the average price paid for a new Peugeot in 2021 to be 0.5% higher than for the average VW.

Transforming Peugeot into the leading mainstream European car maker, as well as expanding the Peugeot, Citroën and DS brands globally, is a tall order, but Tavares’s presentation made it clear he was expecting the reborn PSA to behave in a most un-French way.

It may be a generalisation, but the French car industry has long had a streak of doing things its own way and in its own time, an approach that didn’t suit the modern era in which engineering eccentricity and loyal home markets were things of the past.

Citroën has surely struggled to find a new identity after decades of innovation and eccentricity. It became a kind of mainstream discount brand, stuck with rather plain-jane hatches and MPVs. It, like other French brands, resisted conventional SUVs.

Peugeot probably had the sharpest modern-era brand, thanks to excellent chassis dynamics and smart Pininfarina styling, but it too lost its way, especially in the mainstream hatchback market (307 anyone?), and sales sunk well below the targets it had set itself in the 2000s.

Join the debate

Add your comment

DS as a prestige brand

Presumably this would include actually making their cars 100% as good. Or will they continue the current lazy 'style over substance ' approach and settle for making all their cars variations on a small hatchback with quirky styling flourishes.

"Presumably this would

Give over, German cars have their reliability issues that anyone who isn't blinded by the marketing can see.

"Or will they continue the current lazy 'style over substance ' approach and settle for making all their cars variations on a small hatchback with quirky styling flourishes."

Which presumably differs from your Germanic approach of settling for making all their cars several sizes of the same saloon, or the same hatchback with slightly different headlights?