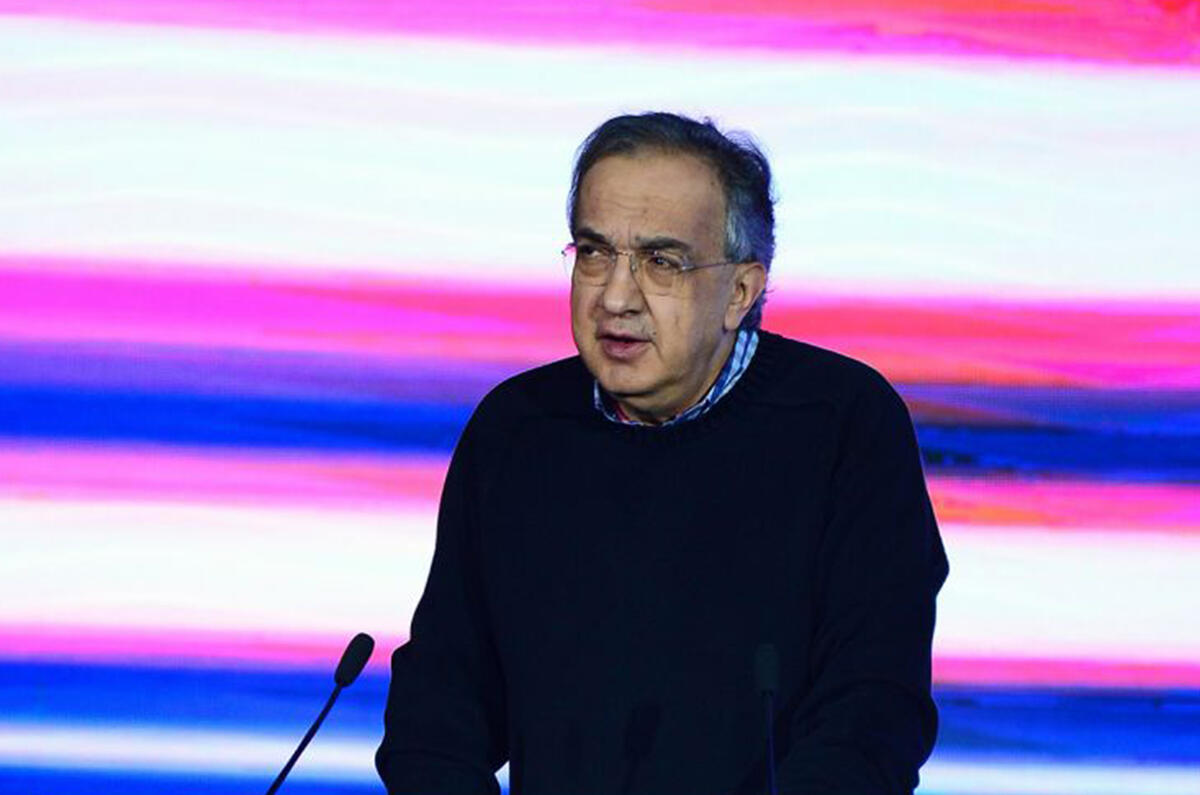

Fiat Chrysler Automobiles (FCA) boss Sergio Marchionne has said that the sale of Opel to the PSA Group is likely to mean a loss of 15 to 20% of the synergies that might have been available from a merger between FCA and General Motors (GM) - but he still believes such a deal would have “huge benefits”.

Linking with a manufacturer from China would be no compensation, he believes. "The benefit of a merger is that you can bring down the costs where you operate," he says. "A Chinese deal might be the thing to do if you're thinking 20 years out, but it's not going to fix the next five years."

Marchionne was scathing about GM's move yesterday of citing "geopolitical uncertainties" as one of its reasons for quitting Europe. "We're paid to manage," he said. "You can't go dividing the world into geopolitical areas." He pointed out that both GM and FCA did business in Latin America, which are hardly paragons of stability.

He also confirmed that he has no intention of selling any of FCA brands, which include which include Fiat, Chrysler, Alfa Romeo and Jeep. When asked at the Geneva motor show, Marchionne confirmed FCA would not sell anything. "After me, you can do what you want," he said, "but while I'm here nothing will be sold.”

Marchionne said there was only one trend that was a certainty - that small-capacity diesel engines were dead. "Everything else is fair play," he said. "The question is not over the technology, but over the customer's ability to afford it."

Opel boss Karl-Thomas Neumann says firm has control of its destiny

Join the debate

Add your comment

After me, you can do what you want," he said,

Too big!