The abolition of the paper tax disc could cost the UK government up to £167 million.

That’s according to the RAC, which says the cost of chasing those who fail to tax their cars – including those who also drive without insurance – could prove to be extremely costly.

The RAC estimates that the cost could be more than 16 times the estimated £10 million of savings the Driver and Vehicle Licensing Agency (DVLA) says it will make by adopting the new system.

According to a survey of more than 2000 motorists carried out by the RAC last month, one third were not aware of any change being made to the car tax system, and almost half were unsure when the changes were due to come into effect.

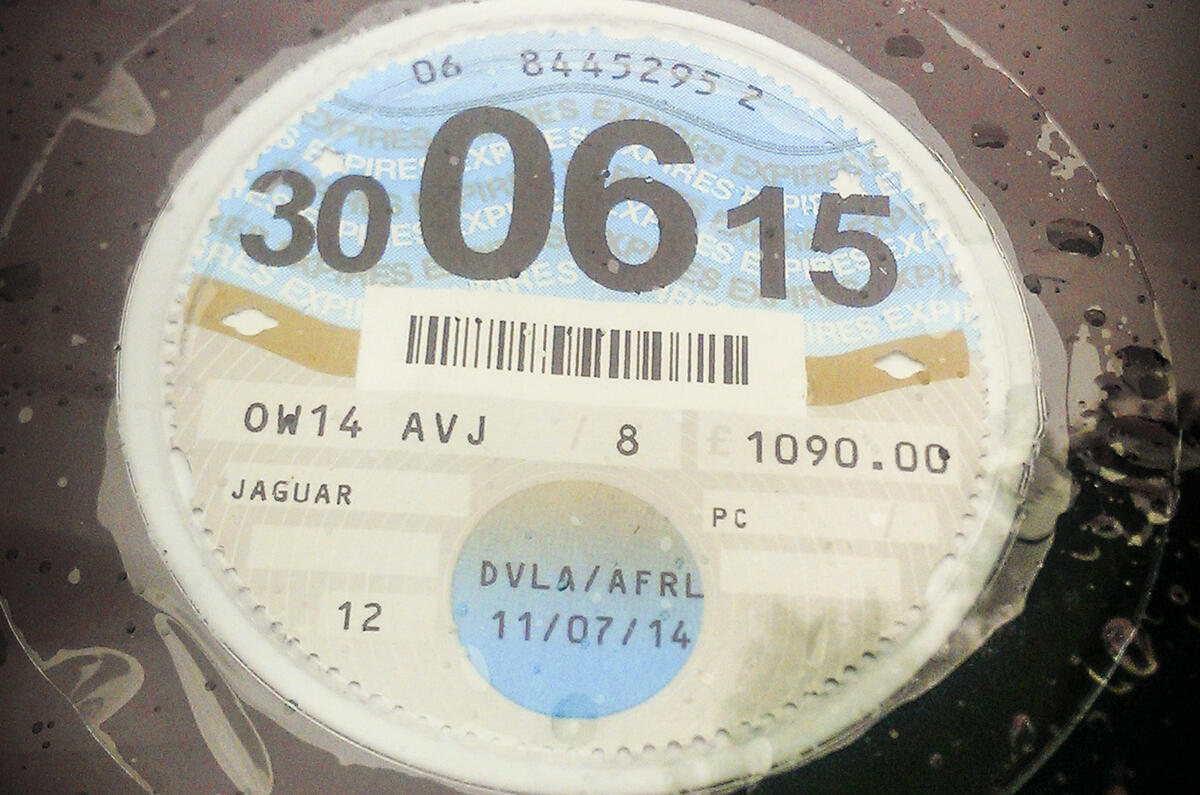

Announced as part of Chancellor George Osborne’s Autumn Statement in December last year, the traditional paper tax disc will be scrapped from 1 October. From that date, drivers will be forced to tax their cars online, and automatic number plate recognition (ANPR) cameras will be used to catch motorists avoiding payment.

The RAC also found that most drivers are unaware that any remaining tax can no longer be transferred to a new owner when a car is sold. Instead, new owners will be required to tax their car immediately, while the seller will receive a refund.

While the Department for Transport estimates that car tax evasion affects just 210,000 of the 31.9 million cars on UK roads – accounting for £35 million in lost revenue last year – the potential financial pitfall is inflated when around one million uninsured UK drivers are also taken into account.

If those drivers also fail to tax their vehicles using the new system, it is estimated that an additional £135 million of revenue will be lost.

RAC chief engineer David Bizley said the new rules would make “very little difference” for the majority of motorists, but raised concerns over how the new rules would be enforced: “Although there is a network of fixed ANPR cameras in urban areas and on motorways and trunk roads, there are inevitably fewer in rural areas.

“And, while police officers have the ability to identify untaxed vehicles, they don’t have the capacity to take on an additional workload.”

There have also been concerns raised that, as is the case with insurance, law-abiding drivers will find themselves paying more for car tax in order to cover those who fail to pay.

However, the DVLA has said the new system will work when it’s activated. A spokesman told the BBC: “There is absolutely no basis to these figures and it is nonsense to suggest that getting rid of the tax disc will lead to an increase in vehicle tax evasion.”

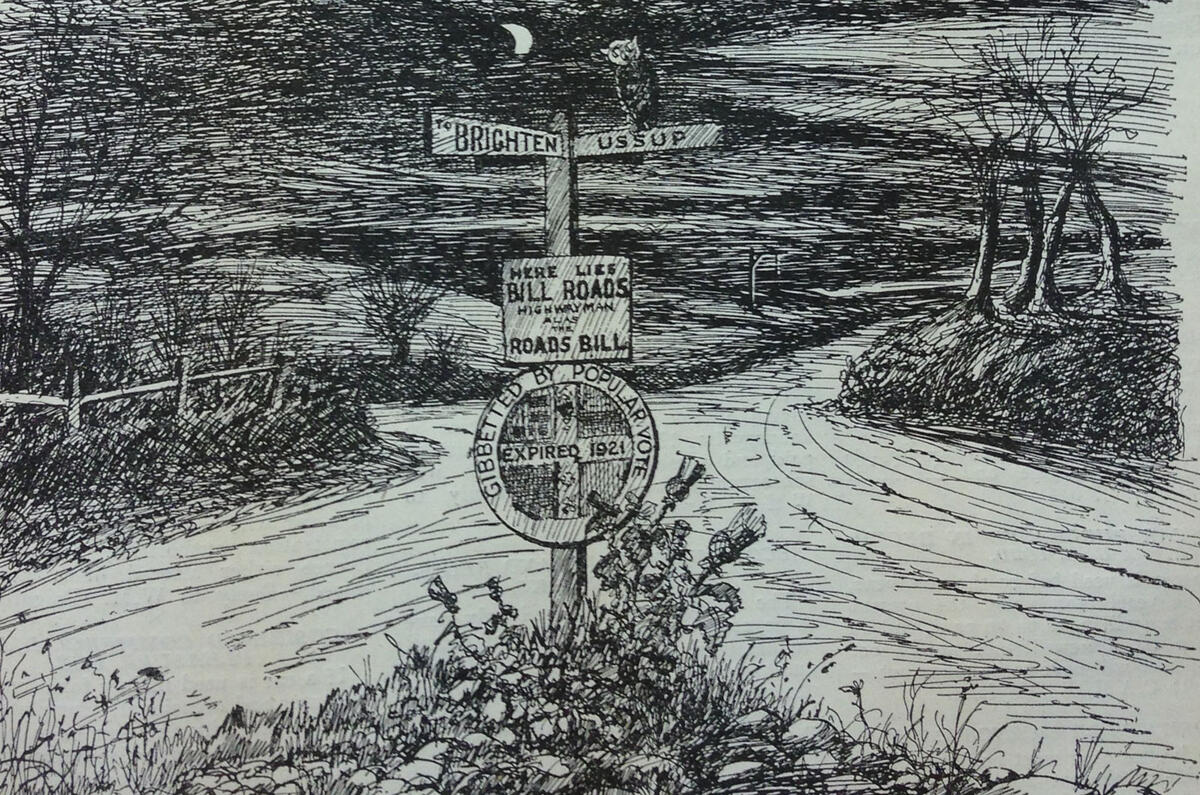

The concept of vehicle tax was introduced in 1888. Paper tax discs were first brought into use in 1921, with drivers initially paying £1 for every horsepower produced by their car.

Get the latest car news, reviews and galleries from Autocar direct to your inbox every week. Enter your email address below:

Add your comment

Luddites voicing

A few things wrong with this system

Only buying on-line will be a nightmare for an awful lot of people. My dad has no idea what the internet is. He has no computer and no need for one either, even if he could afford one. Why should he not be driving just because he can't use a computer? What a load of ageist twaddle!

Using a credit card costs an extra £2.50 at the moment, will that say the same? Of course it will. Same as paying by direct debit, why should that cost more? Because the poor will be the only ones to pay that way.

These camera systems are inherently unreliable, I have free access through the Dartford crossing and 1 in 3 trips the cameras don't read the number plate. The insurance database that the police use can take over two weeks to update with the correct details, the same will happen with the tax database. I have been pulled over twice now because the database wasn't updated properly. I have never been uninsured!

Another government incentive that will cost more money and cause the average Joe more grief! Put a few pence onto the already extortionate fuel prices and be done with road tax, then no-one can dodge it and it will be free to collect too saving billions every year! Simple really, just like politicians!

RAC Nonsense

I'm all for it, but it can causing a large issue with a number of bangers being abandoned or dropped to zero value as they new owner factors in paying for RFL instead of inheriting what's left.