I would imagine most car company boards could do without the attention of the world’s automotive analysts. The latter spend their (long) working days combing over company accounts and offering advice to the people who buy and sell shares.

Brit Max Warburton, senior analyst at Sandford C Bernstein, has often been rated as the number one auto analyst in Europe and stands out from the investment crowd. And that’s because he’s a bloke who not only knows cars and knows the history of the car industry, but also has a seriously good grasp of engineering and production. But perhaps his unique pitch is an impressive ability to take a ‘helicopter view’ of a company and then offer often punchy advice.

So willing is Warburton to get stuck in where he sees a strategy to criticise, that he’s well known for his face-to-face clashes of opinion with Fiat Chrysler Automobiles boss Sergio Marchionne. Last April the two locked horns in public. Investor relations meetings are usually much more subdued affairs.

Warburton’s latest advice was aimed at a resurgent PSA Peugeot Citroën, in a classic good news/bad news note to investors. However, the bad news was that the bad news was especially bad.

Warburton’s opening assessment of PSA’s recent resurrection was impressive, to say the least: "PSA has stormed back into contention in the last 18 months and is now Europe's most profitable mass-market OEM. We believe profitability can remain solid through 2016 and 2017 and we still believe the stock is undervalued. However, with PSA now back on its feet, the discussion needs to turn to sustainability and long-term strategy."

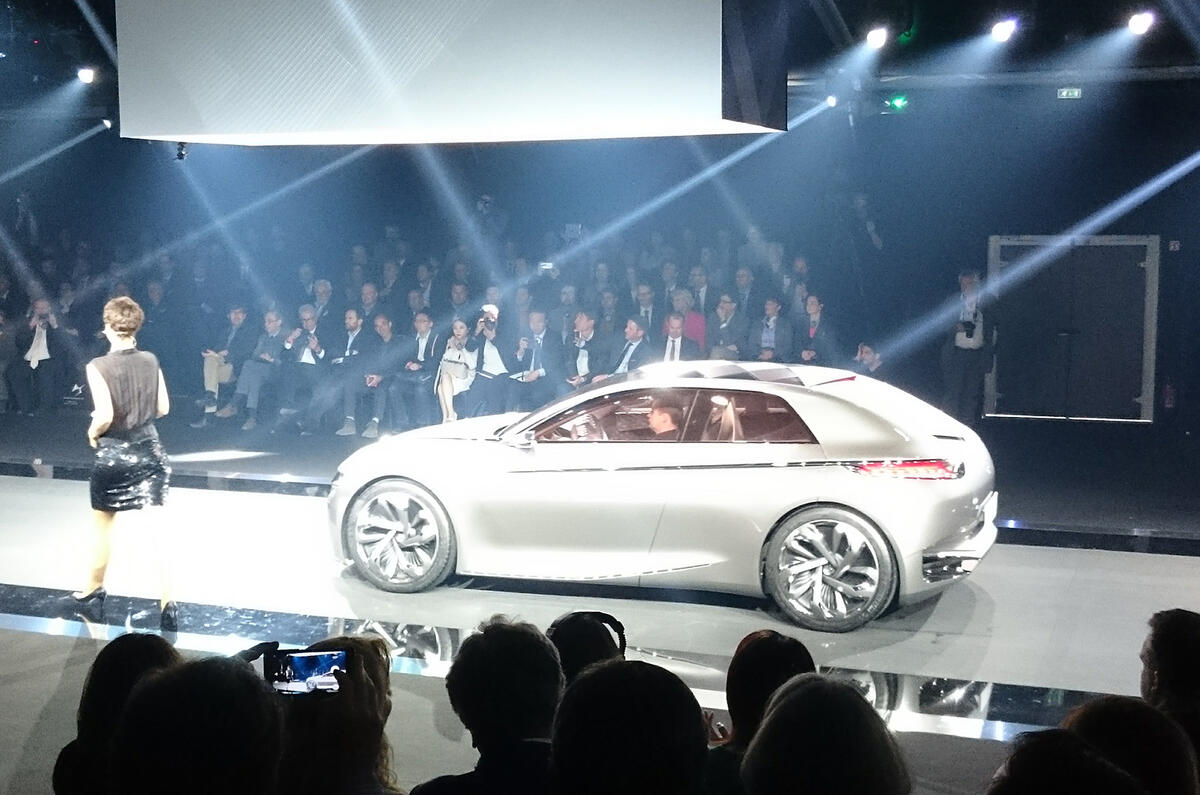

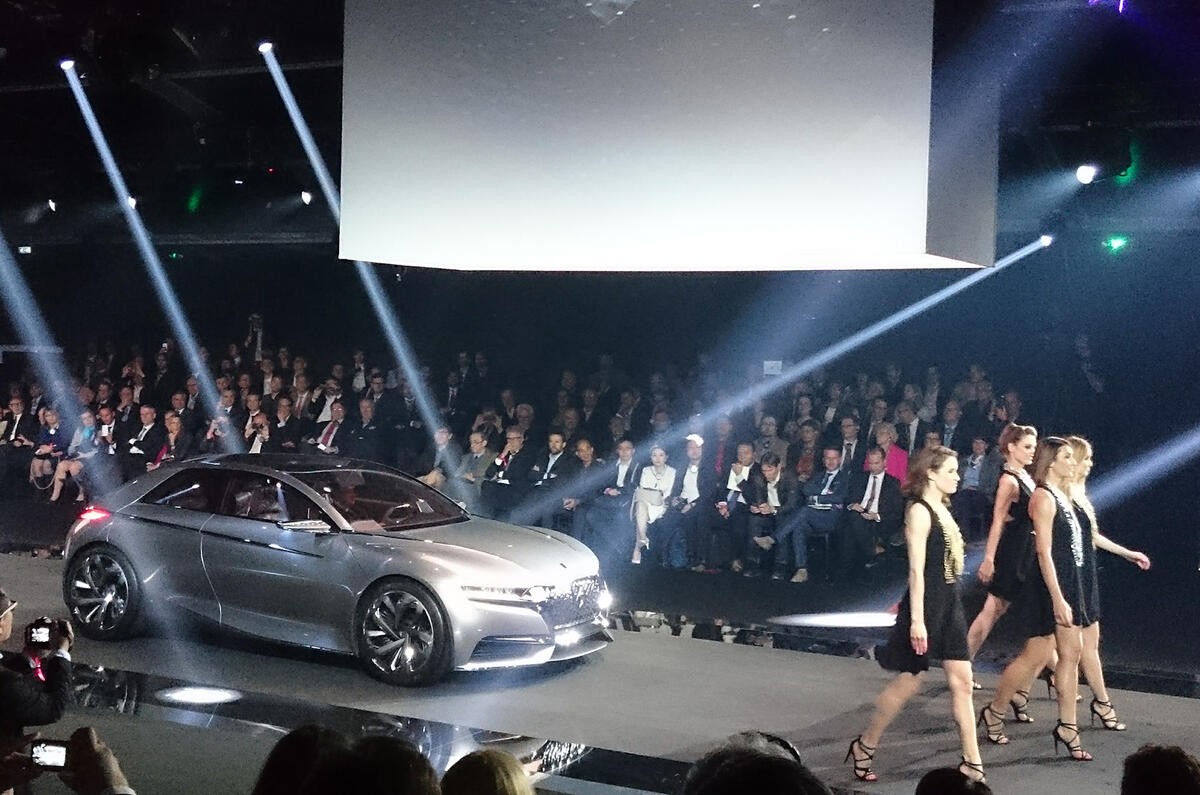

However, he was in no doubt about the financial advisability of PSA’s strategy to build a premium brand around the DS badge. Quite simply, Warburton insisted that the PSA management should kill off the DS brand before it spends any more money on the venture.

"One of the key tenets of PSA's long-term strategy is to develop 'DS' as a third brand and as a 'premium' offering. The company is pumping billions into this project. We believe this is misguided. PSA already has two brands; it doesn't need and can't afford a third. DS is ill-defined, has low consumer recognition and is highly unlikely to generate shareholder returns," he stated.

Warburton’s report goes into surprising detail about the success and advisability of trying to brand-build. The 25-page report was unusual in not just running hard numbers and graphs; it also had pictures of cars including the Pontiac Aztec and Citroen C4 Cactus and even a page of images of current SUVs that was intended to show just how difficult it is becoming to stand out from the automotive crowd.

Many of Warburton’s arguments in the report will be familiar to Autocar readers, especially the point about how long - and how much investment it took - to make Audi into a true premium brand.

"If we look at the average record of efforts to build premium brands, the evidence suggests that they will disappoint. We don't believe even the richest OEMs [original equipment manufacturers] can afford it. Very few can demonstrate that they have been able to generate shareholder value by launching a new premium brand, or even building one up," states the report.

Join the debate

Add your comment

Well it’s now 2018 and he has

Well it’s now 2018 and he has been proven right so far. Sales have collapsed in China to nothing and are fast declining to half former numbers in Europe and here. The strange looking DS7 is not going to change things I fear. Would have been better keeping DS as a Citroen (as it always was) and stop pretending to be a French Audi.

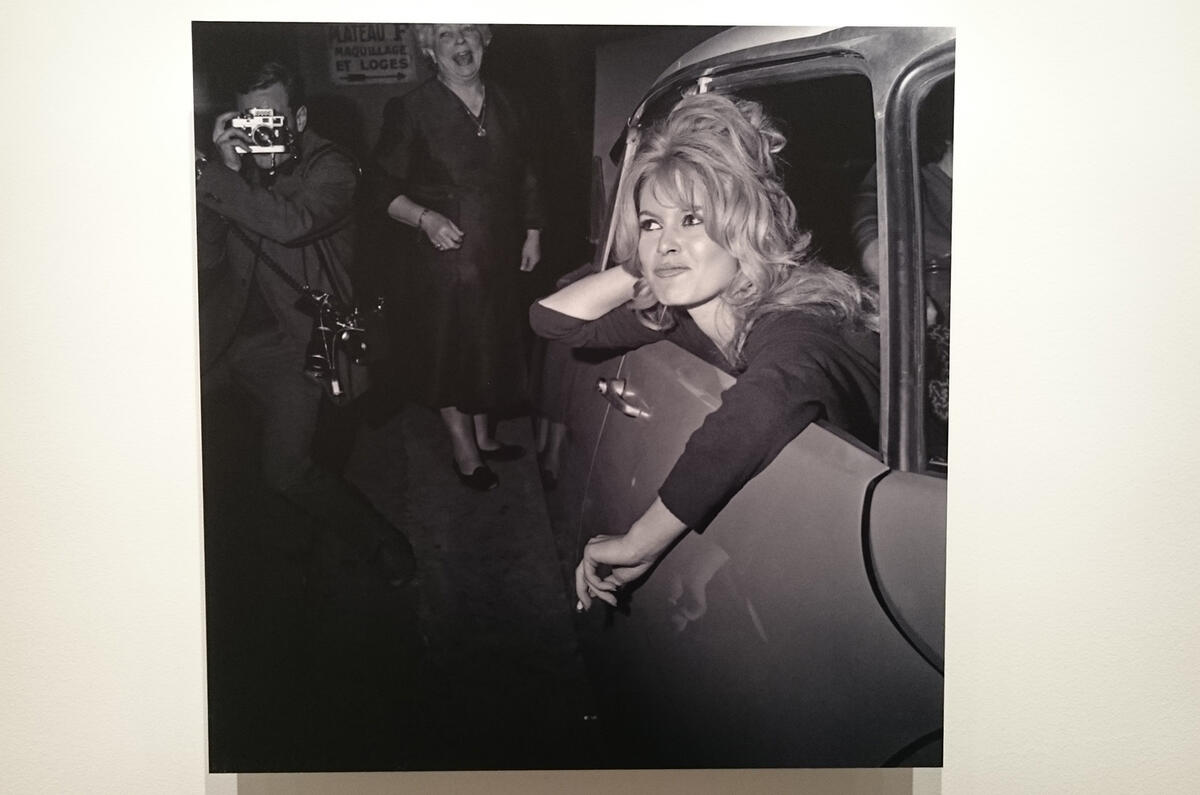

If they want celeb-style Audi

Unfortunately their biggest vehicle, the DS5, isn't going to offer much space up against A8s, S classes etc. so this is maybe a better plan for if the DS9 ever sees the light of day.

totally agreed with max warburton