The doors have just closed on the Australian car manufacturing industry forever. General Motors’ Aussie outpost, Holden, turned out the lights on 20 October, when the Commodore production line fellt silent just two weeks after the local Toyota Camry factory shut.

Holden and Toyota were able to carry on manufacturing for 12 months after Ford closed its assembly line last October because they had higher production volumes, but not enough demand to survive in the long run.

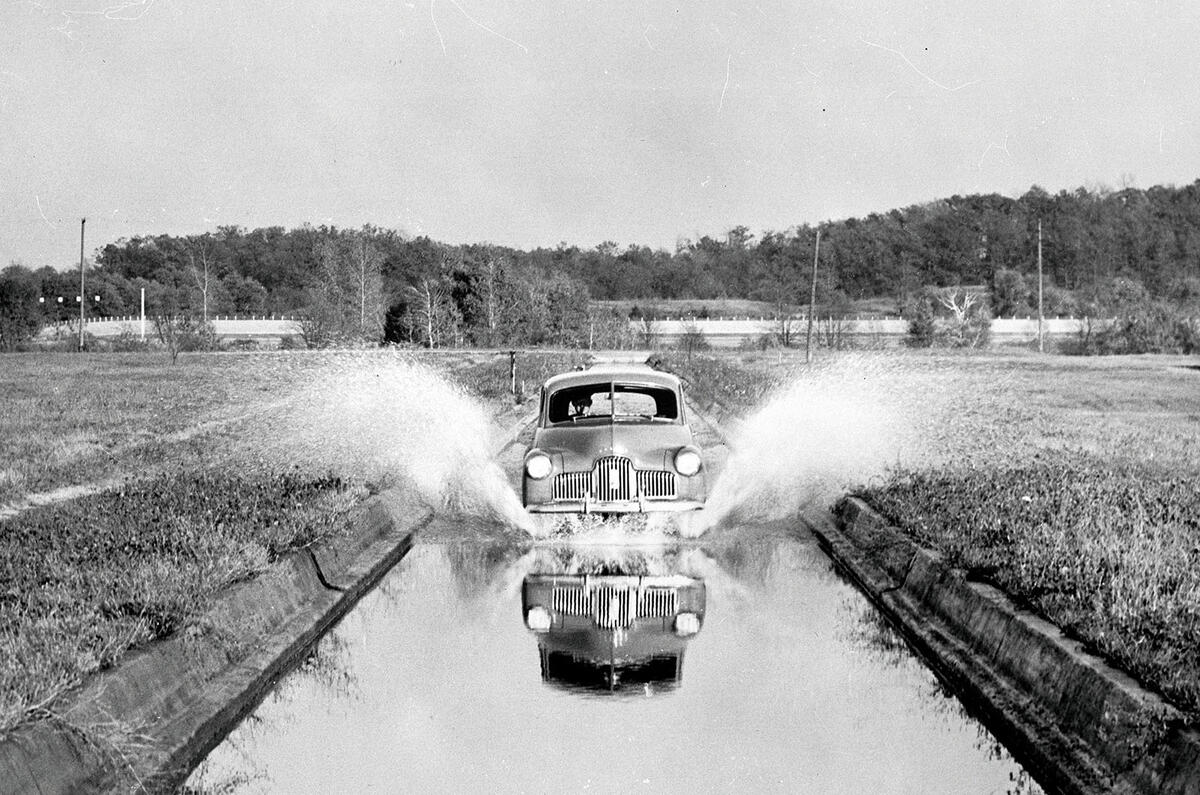

All three brands may be multinationals but they helped shape Australian culture and build the nation. Ford was first to manufacture cars locally, starting in 1925, having shipped cars to Australia since 1904. Holden, a horse saddlery business in the late 1800s that moved into coachbuilding in the early 1900s, became an assembler of foreign cars for GM in 1936 before the US giant acquired the company and gave Holden a car of its own to build in 1948.

Toyota still has a largely Japanese image in Australia, even though it has made cars locally since 1963 and has been the country’s biggest vehicle manufacturer for the past 10 years. Toyota is also Australia’s largest automotive exporter, shipping more cars in 16 years than Holden did over 63 years and Ford did in 91 years, and is the only one of the three to export more than one million vehicles.

Australia was the first country outside of Japan where Toyota made vehicles, which is why it fought so hard to keep its local operations running. It’s believed to be only the second Toyota factory in the world to close. Toyota Australia had secured a large export order to sustain its local operations, shipping seven out of every 10 Camrys to the Middle East over the past 20 years. But its fate was sealed because the local parts supply base could not survive solely on orders for Toyota. The majority of local suppliers manufactured components for all three brands.

Over the decades, the Australian car industry employed generations of workers. But the taxpayer has largely footed the bill, shelling out more than $5 billion (Australian dollars, so about £3.06bn) in industry assistance over the past 10 years alone.

The car industry says it invested three dollars for every one dollar of taxpayer funds. That figure may be debated but one thing is certain: the end was inevitable. With low – or zero – import tariffs over the past decade, Australia became flooded with foreign cars that were either cheaper to buy than local models or better equipped, or both.

There are now more automotive brands sold in Australia than in mainland Europe, the UK, the US or Japan. This had the effect of gradually eating into the volume Australian car factories needed to remain viable. At their peak, Holden built 165,000 cars in a calendar year (2004), Ford built 155,000 (1984) and Toyota built 148,000 (2007). But last year, all three sold a combined total of just 87,000 locally made cars.

Join the debate

Add your comment

Aussie mentality

They all buy mazdas and toyotas in Oz...can you imagine that? and then can you imagine that that's all you can buy?

demise of manufacturing in Aus

Good article but does not mention bloody minded unions sealing the fate of the industry back in 2009. Sweet heart deals feather beding workers and the union guys are still in work when the workers are on the street.

Didn't PSA already announce a 25% job cuts and Elsemere port?

Didnt take PSA long.