Whether you currently use a snazzy magnetic circular holder or prefer the rustic sticking tape approach to affixing your tax disc to your windscreen, George Osborne has just made your life a tiny bit less… perforated.

In today’s autumn budget statement the chancellor has called time on the 93-year-old necessity to shove a piece of coloured paper in your windscreen to prove you’ve coughed up your Vehicle Excise Duty for the next six months or year.

The humble disc, it seems, has become outmoded; the relevant data is held on computer databases, and so the authorities simply run your car’s registration plate through the system.

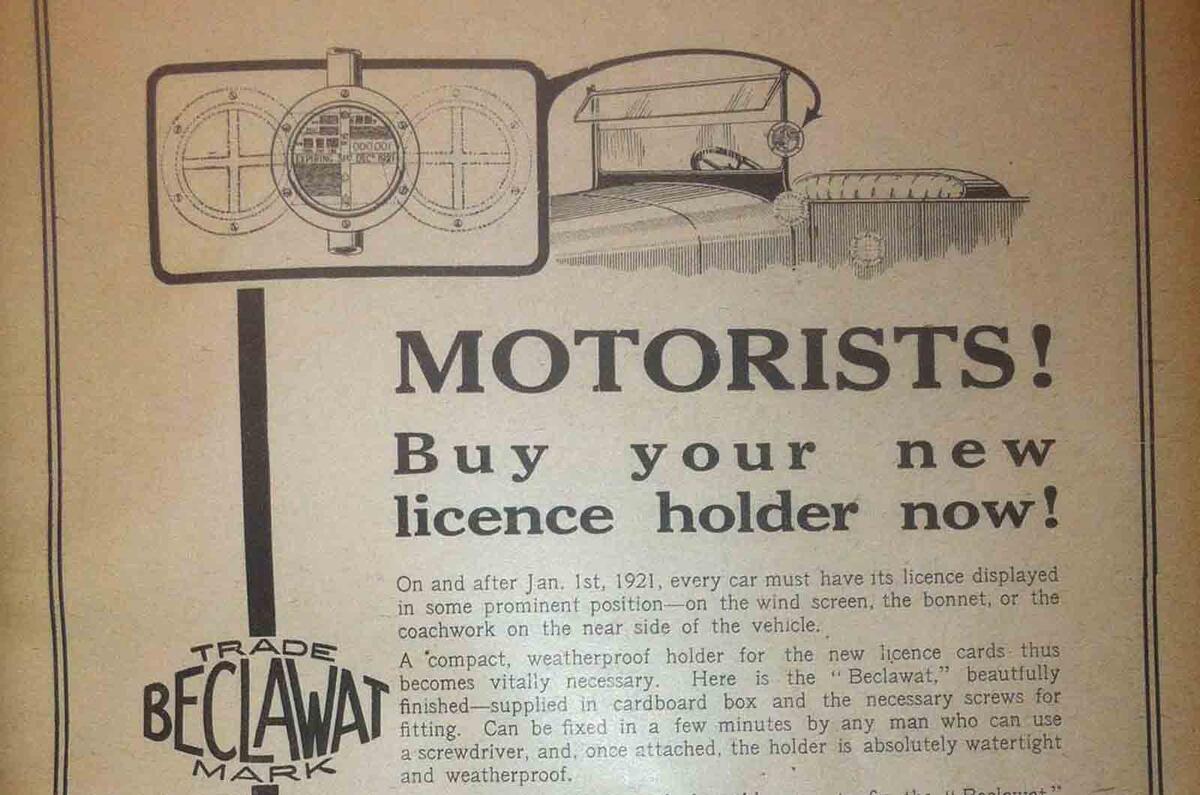

Such a high-tech approach would have confounded the motorists of 1 January 1921, when displaying the tax disc became law, to prove you had paid the new excise duty which had been incorporated into the Roads Act of the previous year.

Autocar of the day was vehemently opposed to the new car tax, which was ushered in with the justification that the money was needed to maintain the road network, and replaced previous convoluted taxation methods that went before with a single method of cash-generation.

Britain had just emerged from World War One, during which the roads had fallen into a bad state of repair. The Ministry of Transport Committee calculated that it needed to raise £7m in taxes to maintain the roads and enable a substantial measure of new road construction and improvement.

How curious is it that £7m is also the figure that the current government believes will be saved by abolishing tax discs?

But the way the country was using motor vehicles was also changing. Autocar’s editorial leader column from 17 April 1920, shortly before the chancellor’s budget, highlighted motoring’s shift from pleasure activity to public necessity: “Motor car taxation, while cars were merely what may be termed toys of the wealthy, was excusable, in that motor transport in that particular form rendered no substantial service to the community.

“But now that motor transport has become a vital necessity, we plead for the freedom of the ordinary use of motor vehicles from the strangling effects of restrictive taxation. To tax all sorts and conditions of motor vehicles will be a deadly blow to the natural development of this modern form of locomotion in its most publicly useful aspects.”

Further articles debated the effect the new tax might have on the British car industry as a whole. With the cost of the tax linked to engine displacement, Autocar posited that British car makers would be discouraged to build large-engined vehicles of the type that were popular in many foreign countries.

Autocar’s readers were similarly disgruntled. In the issue of 25 December 1920, Percy C Beardwood was worried that motorists would abandon cars, to the detriment of traders: “To my mind, the new taxation will only provide further jobs for bureaucracy without increasing the country’s revenue. A ruined industry does not as a rule contribute much to the income tax.”

Join the debate

Add your comment

Tax Disks demise

Oops, forgot I said "sensible" and politics is never remembered for that.............

Crazy idea- Numberplates are not a secure system

CWBROWN, all you say is true.

V5 docs for numberplates

Not just me then :-)