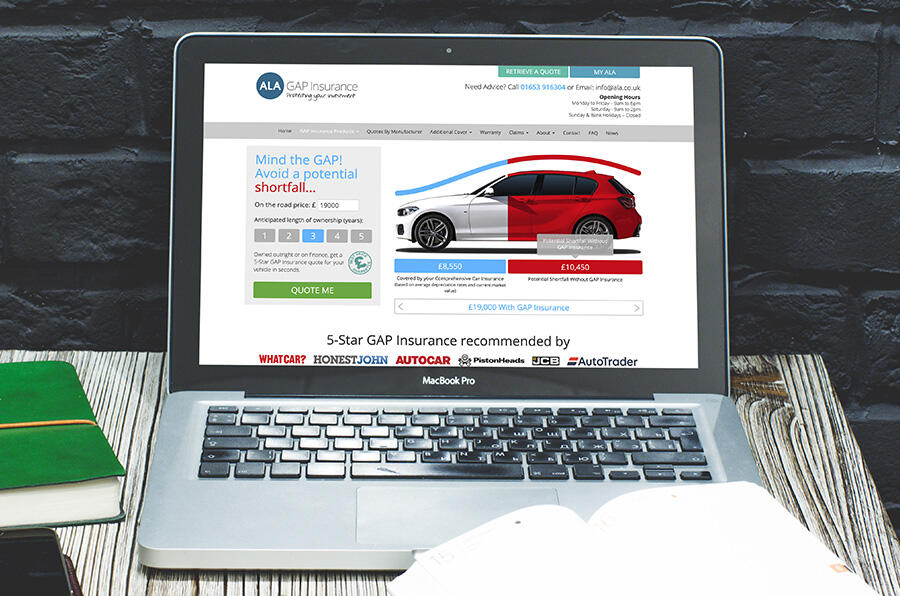

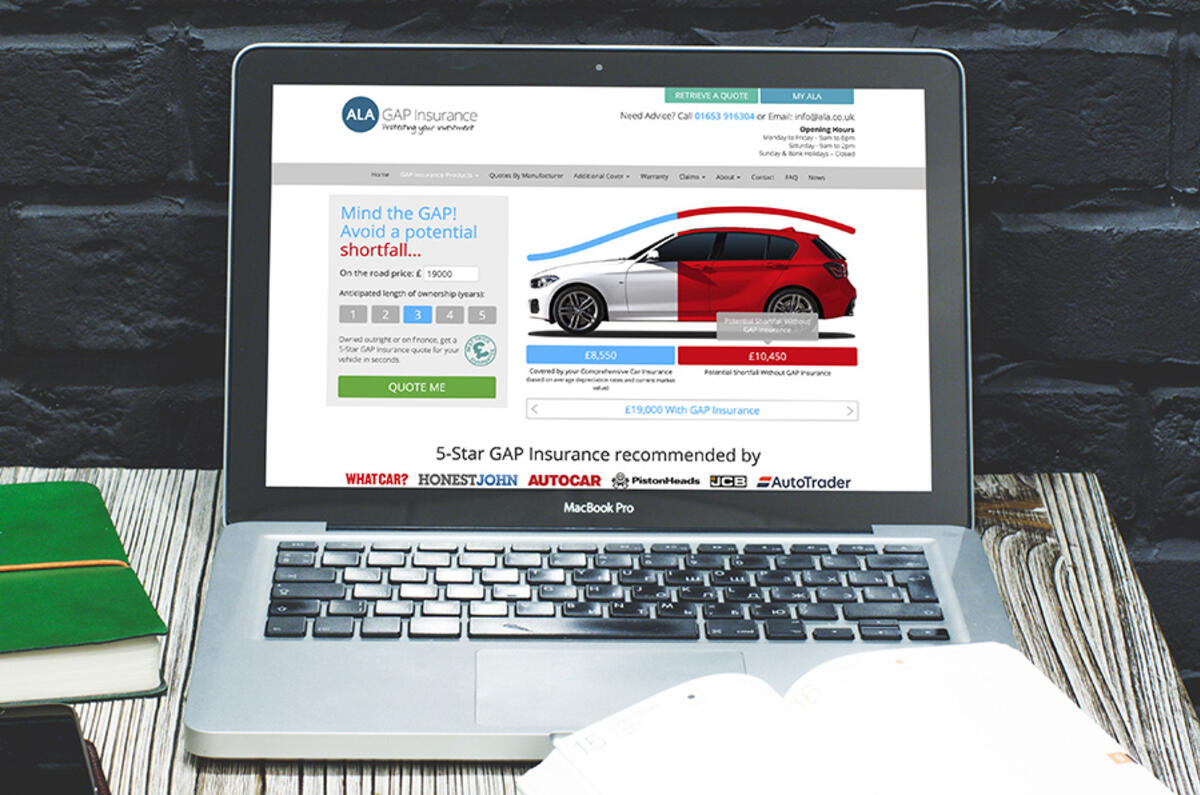

GAP insurance is designed to offer car buyers extra protection, compensating you for any shortfall between the purchase price and market value if your car is written-off or stolen. But, with lots of different policies covering everything from lease cars to second-hand purchases, which cover is right for you?

All cars – new or used – lose value over time, with new cars having a particularly high depreciation of between 40% and 60% in the first three years. That means the car is soon worth much less than you paid for it. This is where GAP insurance – or Guaranteed Asset Protection insurance, to give it its full name – comes in.

GAP insurance isn’t responsible for a full claim if your vehicle is stolen or written off. Instead, GAP insurance bridges the gap between the price you paid for the car and the market value that a comprehensive insurer pays out.

As Jason Allen from ALA Insurance explains: “The insurer won’t cover what the driver paid originally for that vehicle, because insurance payouts are based on the vehicle’s value at the time of the loss – not the value when it’s new."

GAP insurance can also cover the remaining payments in the event of a total loss if the vehicle is leased, or they can cover the costs of replacing the vehicle if it was bought brand new. Effectively, it’s a safety net – in addition to your car insurance – that means you won’t be out of pocket should you incur a total loss.

GAP Insurance comes in many different flavours, so it’s worth thinking hard before accepting the first policy you’re offered. “Generally speaking, car dealers only offer one kind of GAP insurance policy – ‘Back to Invoice’ – which they try to sell to everybody as a one-size fits all solution,” says Jason. “It’s worth shopping around, because third-party insurers like ALA Insurance offer a range of products that can make the policy far more specific to your needs.”

So, what is the best GAP insurance for you? We asked Jason to break down each of the policies available from ALA Insurance and explain which is most suitable for different types of car buyers.

To find out more about the car-related services that ALA Insurance offer, head to ala.co.uk

‘Return to Invoice’: best all-round, especially for premium/performance cars

A ‘Return to Invoice’ (or ‘Back to Invoice’) policy is generally the best all-round option for drivers purchasing a brand-new car outright. It will top up the insurer's payout to the original price of the car or the cost of any outstanding finance payments, whichever is greater.

Add your comment