The car industry - especially auto analysts - look forward to Fiat Chrysler (FCA) business presentations. In contrast, to the tightly scripted presentations delivered by the German car industry, FCA and its mercurial overlord Sergio Marchionne usually deliver the unexpected.

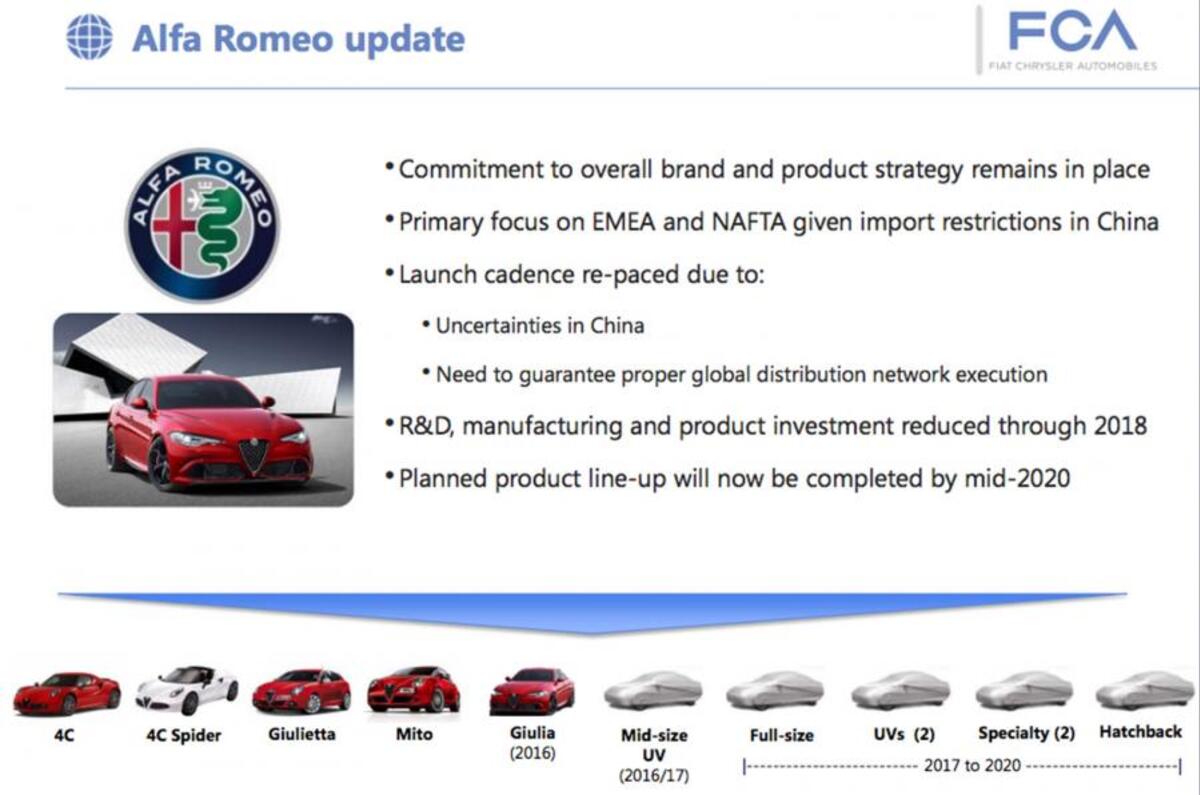

Yesterday’s ‘Business Plan Update’ was another cracker. Firstly, the much-trailed Alfa Romeo revival was delayed again. Putting some of the blame on the state of the Chinese luxury car market, the investments in new Alfa products will be ‘reduced for the next two years’.

What really caught out the markets was Marchionne’s announcement that the Chrysler 200 saloon and the smaller Dodge Dart saloon will be run out over the next 18 months.

Both are relatively new models, but neither has been a massive runaway success. Marchionne was quoted as saying that both cars ‘would go away for a long time’, but held open the possibility of FCA getting back into the sedan market by partnering with another car maker - probably a much less expensive way to stay in the segment.

But there’s sound reasoning why FCA wants to exit a mass sedan market that’s likely to be barely profitable.

And that’s the stupendous rise and rise of the SUV and Crossover in the US new car market. According to FCA, in 2009 the US new car market was made up of 56% road car sales, 29% SUVs and Crossovers and 15% pick-ups.

Last year that shifted dramatically, with road cars down to 46% of the market, SUVs accounting for 37% and pick-ups for 17% of sales. FCA says it thinks this move is likely to be permanent. It also expects fuel prices to remain low for some time to come.

It says there is ‘unmet demand for RAM, Jeep Wrangler and Grand Cherokee models’, which it sees as ‘key high-margin products’. There’s also a new Grand Wagoneer flagship model on the way as well a Jeep pick-up.

This is why the company’s factories are being re-organised so that, by mid-2017 more capacity can be given over to Jeeps and pick-ups.

Last year the Jeep brand sold 1.24m vehicles globally. FCA’s new estimates for 2018 have been revised up from 1.9m vehicles to 2m.

While Jeep growth in the Americas is likely to rise 10% over the next three years, the company says it will jump 137% in Europe, the Middle East and Africa and 375% in Asia-Pacific and China.

It’s the currently the case that SUVs deliver significantly better profit margins than mainstream cars.

With volumes of 2m Jeep vehicles globally in 2018, FCA thinks the wider company will be making profits of £3.5-£4.2bn (the vast majority generated by Jeep and RAM) and will have more than £4bn cash in the bank.

Join the debate

Add your comment

Kinda ironic that Fiat mainly

What's Italian for 'retreat'

What's Italian for 'retreat'