The PSA Group has battled significant global issues and market downturns to achieve a record profit margin and a revenue boost in 2019, bosses announced today.

The operating margin of the French firm, which owns the Peugeot, Citroën, DS, Opel and Vauxhall brands, rose to a record 8.7% in the first half of 2019, while income rose to €3.34 billion (£2.98bn).

This is despite acknowledged weaknesses in several global markets, most notably China, and a need to invest heavily in electrification to meet imminent European Union CO2 emissions compliance rules. PSA also sold nearly 13% fewer vehicles in the first half of 2019 compared with the same period in 2018, down to 1.903 million units, reflecting significant falls in markets such as China and parts of Latin America.

PSA chairman Carlos Tavares on the group's next steps

Reflecting on the record margin, PSA CEO Carlos Tavares told media during the conference: “Can you imagine that despite this number, we still continue to argue and express that we are not happy with everything we do. They [board members] accept that we continue to push, to steer the company in the right direction.

“We want to be a great car maker, not the biggest one, but the most efficient car maker in the world”.

Tavares claims PSA has achieved its objectives of improving market share in “all the major markets in Europe” and made significant improvements in customer satisfaction, claiming it's in the top four in Europe for sales satisfaction and that, according to analysis firm JD Power, Peugeot is the UK’s most reliable brand.

Strong performance despite multiple market and industry challenges

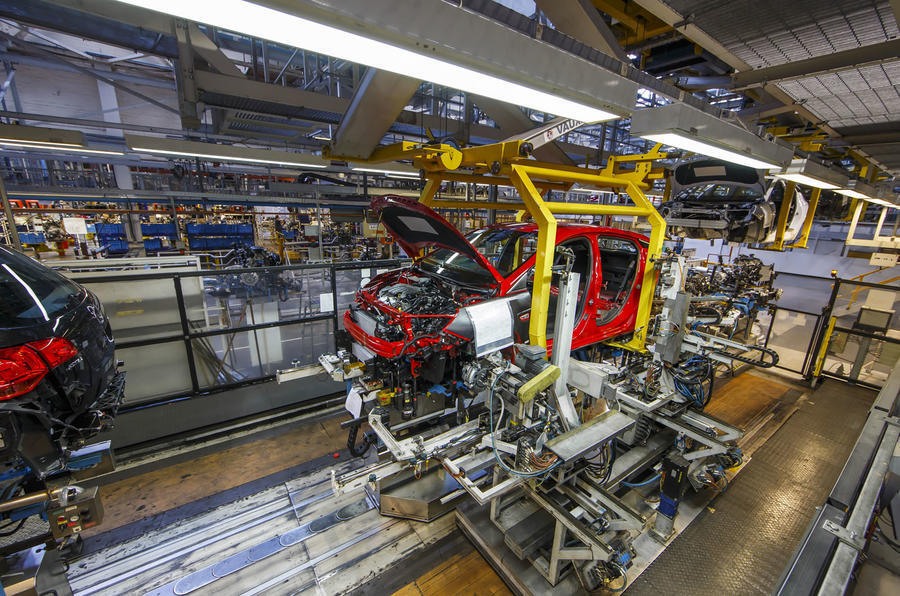

However, Tavares acknowledged significant global challenges, including the fact that PSA's market share has more than halved in China down to 0.5%. The slump in diesel sales, a huge ongoing investment in electrifying its model line-up and “significant” over-capacity issues in factories such as Britain's Ellesmere Port are also highlighted.

Join the debate

Add your comment

A very good set of results

A very good set of results where PSA have focussed on delivery and seem to know exactly what they’re doing - I mean an 8.7% profit margin is premium & luxury territory from a mass market producer

speaking as...

a life-long Citroeniste - if that's how it's spelt - and very disheartened with how things have been going over the last decade, i can't help but be happy that things are finally on the upturn again. It still feels like there's something missing though. Yes, obviously, i want the hydraulics back... "nothing moves you like a citroen"